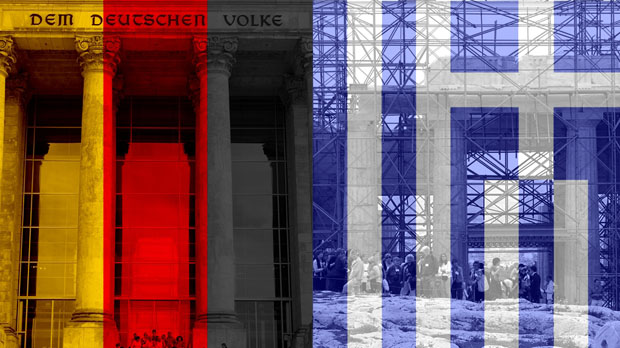

Is a two-tier eurozone a way out of the crisis?

Sources in the EU say Germany and France are looking at a smaller eurozone, but economists tell Channel 4 News it will be a “Pandora’s box” and “the message from the Greek myth was do not open it”.

Reports from within the EU suggest that German and French officials have been looking at plans to radically overhaul the European Union, moving towards a more integrated but smaller euro zone.

The discussions come as efforts continue to stabilise the economies of Greece and Italy – with fears focusing on Italy in particular, the fourth largest economy in Europe. The current bailout fund from the European Financial Stability Facility (EFSF) isn’t big enough to support months of payments to Italy. And if Italy did go into “bailout” status, that would mean even less payments into the fund, which Italy is currently contributing to.

A senior EU official, speaking anonymously, told Reuters: “France and Germany have had intense consultations on this issue over the last months, at all levels. We need to move very cautiously but the truth is that we need to establish exactly the list of those who don’t want to be part of the club and those who simply cannot be part.”

Snowblog: The unfolding crisis that will affect us all

The French finance ministry denied plans are under way to shrink euro membership, with a spokesman saying: “There have been no conversations between French and German authorities at any level on decreasing the size of the euro zone.”

But could a smaller zone by a way to create an orderly break up? Channel 4 News has spoken to several economists, who pointed out the inherent difficulties in any plan that would see Greece or Italy return to their former national currencies.

Read more: The eurozone debt crisis that keeps repeating itself?

Raoul Ruparel is head of economic research at think tank Open Europe he told Channel 4 News that some changes to structure are possible, but that returning to former currencies could be a nighmare to resolve: “There has been an idea floated before about Germany and other northern European countries leading and forming a new bloc. It would be possible, I think a country leading from the top is better than someone dropping out of the bottom.

But he sees political complications under any breakaway scenario.

‘Huge political divisions’

“You could have a split-off group, excluding France to start with because its economy is more like the southern European countries, which is politically difficult.

“The left over countries would go back to national currencies and perhaps work towards rejoining it. Or they could try to have a separate eurozone bloc. It’s not really viable, the two-tier Europe, it would always be one being the worse euro than the other. If the break up didn’t go smoothly it could create huge political divisions.

“It would be very hard to have two euro zones, people wouldn’t want to invest in southern Europe. You would have to completely restructure budgets, restructure the European Central Bank, have new rules about capital flows between the two blocs, some new controls. It’s almost impossible to imagine, particularly breaking up the ECB.”

‘They want to keep Greece in’

Dr Stephanie Hare is a Senior Analyst at Oxford Analytica. She says that European leaders are unlikely to support a break up, because of what it would involve. She told Channel 4 News: “Right now, even the EU acknowledges that EU banks are exposed. They won’t want to do anything that will allow Greece to default in the short and medium term. The banks are not ready, they are too vulnerable.

“There are scary figures about French banks’ exposure to Greek debt but they look manageable compared to exposure to Italian banks. The French went on a buying bonanza several years ago for Italian bonds. It looked safe, Italy is a G7 country, the idea that it could need a bail out was inconceivable.”

She says break up may be avoidable and that there are other solutions, although none are guaranteed to work.

“Not all Italy’s debt is coming up for repayment at the same time,” she explained.

“The bailout fund is not big enough for Italy but it doesn’t need to be big enough to save the whole debt. It just needs to shave off 20 per cent. It’s not a country that has no money, it’s not insolvent, it’s a liquidity issue. I’m not saying long term prospects are great, it has to implement substantial political reforms and it’s weak politically. But it’s not Greece.”

Greek banks would be emptied, the banking system would collapse, the successor currency woud plummet in value. Professor Iain Begg, the London School of Economics

“In a rational world Italy would squeak by, but the world is not rational.”

Even the weaker countries, such as Greece, may not accept lightly the idea of a break up, as Stephanie Hare said: “Greece doesn’t want to leave the euro area, 70 per cent of the population there are happy in the euro. And for the people who are owed the money it’s better that Greece stays in the euro.”

Other economists agree that even a partial step back from the euro from the weaker countries would be extremely difficult to manage.

Professor Iain Begg is an expert on EU integration at the London School of Economics. He told Channel 4 News: “Any discussion of euro zone break up has to consider the outcome. It could be a return to 17 national currencies, the exit of one or a small number of members or a crude north-south split. I don’t see any as probable, only the exit of Greece – as things stand – has the slightest chance of happening.”

And he points out that even if Greece left, there would be huge and undesirable consequences.

Technical obstacles would include new notes, new coins, new machinery and new legal contracts.

“It Greece were to exit it would face severe problems. In advance of that decision Greek bank accounts would be emptied, the banking system would collapse, the successor currency would plummet in value, leaving debts owed in euros much higher and causing rapid price inflation. It’s not a pleasant scenario.”

He says technical obstacles would include new notes, new coins, new machinery and new legal contracts.

“Break up would be associated with exchange rate volatility that would make the process volatile or even unstable. It’s Pandora’s box – and the message from that Greek myth was do not open it.”

-

Latest news

-

Why is the UK not exploiting technology for net zero trains?6m

-

Hamas launches rockets at Tel Aviv after 81 people killed in Gaza3m

-

What are the politics behind Rishi Sunak’s national service plan?7m

-

Rishi Sunak pledges to bring back national service4m

-

Chelsea Flower Show: A sanctuary for survivors of torture3m

-