Oil shock: unrest in Saudi Arabia ‘worst case scenario’

As oil prices remain high in the face of unrest across the Middle East, a senior oil executive warns Channel 4 News violence in Saudi Arabia would be “as bad as it could be” for the world economy.

The protests which have spread across the Middle East and North Africa have deposed dictators and changed regimes. But for economists, they have also had a profound effect on a key global product: oil.

Three months ago, the price of oil was $91.32. Since then, as uprisings have spread across countries including Egypt, Tunisia and Libya, it has rocketed by almost a third to reach more than $118 on Monday, a two-year high.

For the global economic situation, if there is a major political uprising in Saudi Arabia, that’s just about as bad as it could be. Bob Gray, Simmons & Company International

This dramatic rise has come despite the fact that global oil production has not been particularly disrupted. Libya, where production has all but halted in the fighting, accounts for only two per cent of the world’s oil.

But analysts say the market is pricing in the “worst case scenario” for oil – that unrest spreads to Saudi Arabia, perhaps the most important oil-producing country in the world.

Protests and implications

Protesters in Saudi Arabia have called for a “day of rage” on Friday to show their dissatisfaction with King Abdullah’s regime. He has tried to head off serious unrest in the country by pledging to boost spending on housing, social welfare and education – and by banning the protests.

But fears remain that the popular uprising could spread, with profound implications for the global oil market.

Bob Gray, Managing Director of Exploration and Production at Simmons & Company International, one of the most respected oil banking companies in the world, told Channel 4 News that unrest in Saudi Arabia was a huge risk for the global economy.

“For the global economic situation, if there is a major political uprising in Saudi Arabia, that’s just about as bad as it could be,” he said.

Saudi Arabia was a “swing producer” – available to turn on – or off – the tap to cope with decreased or increased supply, he added.

Global economy

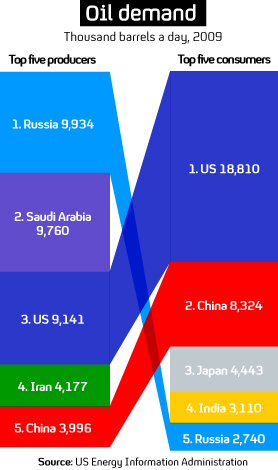

The country has one-fifth of the world’s oil reserves, according to the US Energy Information Administration, and vies for the top of the table in terms of production with Russia.

“If there was a seismic event in Saudi Arabia, would the global economy be able to sustain that?” said Bob Gray.

“There would be a definite spike in prices if something significant happened. We’re looking at a huge proportion of the world’s production affected. That’s going to have an impact on the price and supply.

The worst case scenario is an absolute disaster. But it’s less likely. David Strahan, energy writer

“And could anyone step in to address the shortage? The short answer is no.”

David Strahan, author of The Last Oil Shock: A Survival Guide to the Imminent Extinction of Petroleum Man, agreed that the implications could be huge, but stressed that the likelihood of collapse was low.

“If the oil in Saudi Arabia is cut off in political uprising, that’s very very serious. It has most of the spare capacity,” he told Channel 4 News.

“So it’s like the flagship of the fleet going down, and if that flagship had all of the life boats. It’s a double effect. But the Saudi Arabian authorities are likely to be just as ruthless, and probably more efficient, at controlling their population than the Libyans. The worst case scenario is an absolute disaster. But it’s less likely.”

Ultimately, Bob Gray said, any event that hit Saudi Arabia’s production could lead to a “very significant oil price shock”, although it may be an unlikely scenario.

“Even if we are not looking at Kuwait in 1991, when the oil wells are burning, we could be looking at longer-term disruption. The question is what the global community would do to seek to address the situation – would the West or the US allow this to happen?”

Strategic stocks and other producers would not prevent problems – which the market is already anticipating, he warned. If unrest in Saudi Arabia hit oil production, countries in the west would face rising oil prices, queues and possibly Government rationing.

Read more from Channel 4 News: Arab revolts - Middle East uprising

“It may not be as bad as the 1973 queues but something like that,” he said.

Crises like this raised questions over the oil market, he warned. The problem for the west was that most of the cheap, easy resources were in the Middle East – and controlled nationally – while other sources, controlled by western companies, were deep and expensive, such as off the coasts of Brazil and West Africa.

Author Mr Strahan agreed.

“Everyone is fixated on the Middle East leading to a repeat of the 1970s oil shock,” he said.

“In the short term that may be true, but my view is that the long term geological shock of oil shortages will be much more serious. I think a lot of people feel that, like in the 70s, the taps will be turned back on after all this. My response would be, ‘I wish’. This should show the severe danger of what could happen not too far ahead is a geological shortage – and sooner than the International Energy Authority or governments want to accept.”

In a paper published this week in the Energy Policy Journal, the Oil Depletion Analysis Centre, of which Mr Strahan is a trustee, also warned the world to prepare for a more severe crisis than the current Middle East uprisings.

‘Massaging the figures’

Worries over the long-term outlook for the oil market are compounded by fears that Saudi Arabia’s stocks may not actually be as big as they claim. Matthew Simmons, the late founder of Mr Gray’s firm, sparked global controversy when he suggested this in his 2005 book Twilight in the Desert: the Coming Saudi Oil Shock and the World Economy.

The world uses 86 million barrels of oil a day. There is no room for manoeuvre. If something goes wrong, the whole system falls apart. Bob Gray, Simmons & Company International

“The very big question is how big Saudi Arabia’s reserves ultimately are,” said Bob Gray.

“The statistics say their proven reserves are 260bn barrels. That’s not changed since the 80s – for someone in the industry that’s impossible to explain. It means that every year through exploration, they find as many barrels as they produce. So you have to question their ability to maintain their role – the worrying question is, has Saudi Arabia been massaging the figures to placate the west or for internal politics?

“The west is between a rock and hard place in terms of energy security. Given that resources are located in places where people do not like us, how can we get access to cheaper oil?”

Because of this, any significant disruption posed disaster-scenarios in the oil market.

“The world uses 86 million barrels of oil a day,” he said. “There is no room for manoeuvre. If you take the swing producer out of the equation, something has got to give. It’s like driving on the M25 – if you shut one lane, because the road is operating at 99 per cent capacity – if something goes wrong, the whole system falls apart.”

When oil and blood mix

When I was young Esso used to urge us to "put a tiger in your tank when filling up with petrol. These days some are trying hard not to consider what we are putting in our tanks at all.

Is it Libyan, Saudi? Kuwaiti? From which particular oppression does it flow?

The ingredients are set for a good deal of blood to find its way into the Saudi oil supply...This is the eerie overture to something which could prove, after Friday Prayers this week, everything or nothing. We oil consumers, we who have depended upon this and other repressive Arab regimes to prop up our systems are holding our breath.

Read more from Snowblog: when oil and blood mix