IMF slashes Britain’s growth forecast

The International Monetary Fund says economic growth in Britain will be lower than expected this year and the government may have to delay its tax and spending plans.

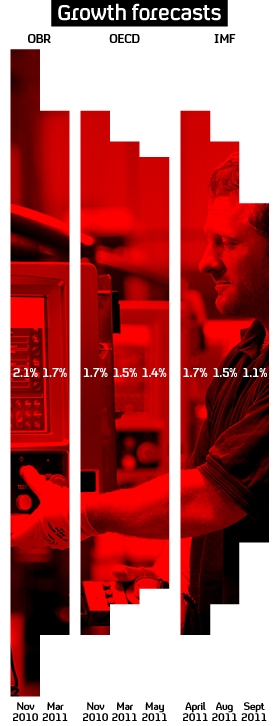

The IMF predicts growth of just 1.1 per cent in 2011, compared with its last estimate in August of 1.5 per cent. This suggests a slowdown since last year, when the economy grew at 1.4 per cent.

It says Britain should delay its plans to cut spending and raise taxes if growth continues to weaken. “If activity were to undershoot current expectations, countries that face historically low yields should also consider delaying some of their planned adjustment (Germany, United Kingdom).”

In an interview with Channel 4 News, Business Secretary Vince Cable conceded there were risks in the government’s approach, but said the alternative was “gambling with our fiscal rules.”

The IMF sees Britain growing more slowly than most advanced economies, with Italy, Spain and Japan the exceptions. If the forecast is right, the government may have to revise its tax and spending plans, which are based on growth of 1.7 per cent.

Britain’s growth forecast for 2012 has also been downgraded from 2.3 per cent to 1.6 per cent.

The world is a very dangerous place at the moment. Business Secretary Vince Cable

Mr Cable told Channel 4 News “the world is a very dangerous place at the moment”, adding:”There are dangers in both directions. That is a risk, we’ve confonted it, we think it’s a lesser risk than gambling with our fiscal rules and undermining confidence and precipitating the kind of problem that’s happened with other countries, notably in southern Europe, where you lose the confidence of the market, your interest rates go up dramatically, you have to pay more on government debt. We don’t want to take that risk.”

Shadow Chancellor Ed Balls said: The IMF is saying very clearly that if slow growth continues in the UK the Government should change course and adopt steadier deficit plans. But since this is now the third time this year the IMF has downgraded its forecasts, we can’t afford to just sit back and wait for things to get worse.”

The independent Office for Budget Responsibility (OBR) will publish its latest growth forecast for the British economy on 29 November, the day Chancellor George Osborne makes his autumn statement to the Commons.

At the time of his last budget in March, the OBR was predicting growth of 1.7 per cent this year. But in a speech on 7 September, Mr Osborne signalled that growth would be downgraded by November.

In a speech in London on 9 September, IMF chief Christine Lagarde gave her support to the government’s programme of cuts, but said economic policy had to “remain nimble” in the face of weak growth.

Ms Lagarde said: “The policy stance remains appropriate, but this heightened risk means a heightened readiness to respond – particularly if it looks like the economy is headed for a prolonged period of weak growth and high unemployment.”

The IMF predicts global growth of 4 per cent this year, down from the 4.5 per cent it forecast in June. The forecasts follow Standard and Poor’s decision to cut Italy’s credit rating because of the country’s debts.

The IMF’s bi-annual world economic outlook reports says: “The global economy is in a dangerous new phase. Global activity has weakened and become more uneven, confidence has fallen sharply recently, and downside risks are growing.”

Chief Economist Olivier Blanchard said: “Strong policies are urgently needed to improve the outlook and to reduce the risks. Only if governments move decisively on fiscal policy, financial repairs, and external rebalancing, can we hope for stronger and more robust recovery.”

If correct the UK economy will have grown more slowly in 2011 than 2010. The IMF's forecast is well below the 1.7 per cent currently used by the government, and could spell more trouble for the public finances.

Read Economics Editor Faisal Islam's blog