The Crown Prosecution Service has announced it will press for longer sentences for benefits cheats.

Director of Public Prosecutions Keir Starmer QC says suspects will now be charged under the Fraud Act instead of social security law, which could mean a maximum sentence of 10 years instead of seven.

And small-scale fraudsters who used to be sent to the magistrates’ court could now find themselves in the crown court, with the prospect of much stiffer sentences.

Mr Starmer added: “The cost to the nation incurred by benefit fraud should be at the forefront of lawyers’ minds when considering whether a prosecution is in the public interest. The loss of £1.9bn of public money has a significant impact on communities up and down the country.”

A long-overdue clampdown or a waste of resources? You be the judge.

The analysis

The CPS says fraud in the benefit and tax credit system costs us £1.9bn a year. That’s about right, if a little out of date (it’s based on 2009/10 figures).

The latest estimate is a shade higher. The Department of Work and Pensions, which spent on welfare payments like the state pension and housing and unemployment benefit in 2011/12 says fraud cost them £1.2bn in that year.

HMRC, which pays out child and working tax credits and child benefit, identified £870m in fraudulent claims in the same year.

So if we combine the central estimates from both departments, the total amount of money lost to fraud across the benefits system was a little over £2bn in 2011/12.

To put that into perspective:

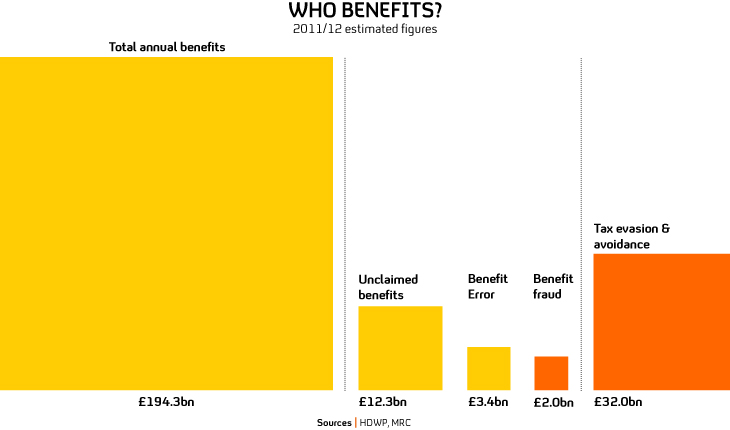

Fraud accounts for about one per cent of the total annual benefits and tax credits spend, which ran at £194.3bn in 2011/12.

Fraud isn’t getting worse

DWP says 0.7 per cent of its benefits were overpaid this year due to fraud. The percentage was exactly the same last year, and it was a fraction higher in 2010/11 – 0.8 per cent.

“Error” costs more than fraud.

Across the whole system, fraud cost us £2bn and error – in the form of honest mistakes made by claimants or official cock-ups – cost £3.4bn last year.

This is only a fraction of the money lost from tax evasion and avoidance.

HMRC puts this figure at £32bn but tax campaigners say the real “tax gap” is much higher.

Richard Murphy from the Tax Justice Network thinks tax fraud could be 50 times bigger than benefit fraud.

The cost of fraud is dwarfed by the surplus from unclaimed benefits

The figures are a bit shady but DWP say between £7.5bn and £12.3bn of the six main benefits it administers were left unclaimed in 2009/10.

To this figure of around £10bn we can add several billion more in unclaimed tax credits, although HMRC is reluctant to tell us the real figure.

It did direct us to this near-incomprehensible document, which appears to suggest that childless families alone are missing out on £2.3bn in tax credits.

That can only be the bare minimum. We know that 4 per cent of families don’t claim child benefits and 17 per cent don’t claim child tax credits. But how much money does that equate to? The taxman can’t or won’t tell us.

Prison costs money

Today’s announcement was all about longer sentences for fraudsters, which may or may not make sense from a purely financial perspective.

It costs the state just under £35,000 on average to keep someone in prison for a year. So every fraudster who gets a maximum 10-year sentence instead of seven years will cost the taxpayers tens of thousands more.

And a push by the CPS for more serious charges and more crown court cases will also mean the state foots a bigger legal bill.

Of course, if stiffer sentences have a deterrent effect we could save money in the long run.

By Patrick Worrall