Iain Duncan Smith says benefit cheats make his blood boil. Last night Channel 4 News asked the work and pensions secretary if tax evaders and avoiders had a similar effect on him.

He gave a robust defence of the government’s record on tacking tax dodgers.

Did his answers pass the FactCheck test?

“ 2,600 people have been prosecuted and gone to jail for tax evasion as a criminal offence.”

2,600 people have been prosecuted and gone to jail for tax evasion as a criminal offence.”

Not quite. There have been just over 2,600 prosecutions, but not all of those people have been convicted, let alone gone to jail.

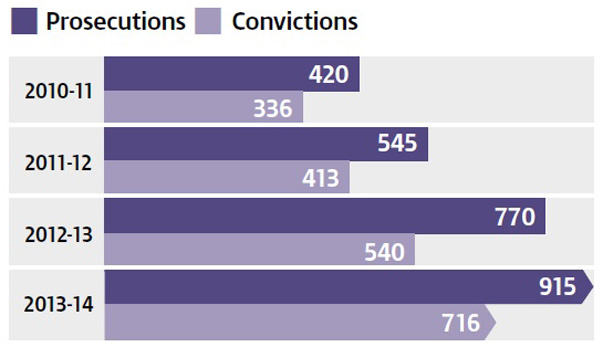

Here’s how it breaks down year by year, according to HMRC:

That’s 2,650 cases prosecuted between April 2010 and March 2014, but only 2,005 successful convictions – a conviction rate of 75 per cent.

More than 2,700 years of prison sentences have been dished out to offenders over this period (Mr Duncan Smith actually said “hours” instead of years) but that doesn’t mean all of the people convicted were jailed.

It is fair to say that there has been a big increase in cases taken to court during this parliament. HMRC’s goal for 2014/15 is 1,165 prosecutions and it says it is “on target” to hit that number.

But it’s not clear to us whether all these cases really concerned tax evasion in the sense that most of us understand it.

In another press release – confusingly covering calendar years, not financial year – HMRC claims similar numbers but states: “The investigations covered everything from complex VAT, income tax and benefit frauds to smuggling cases.”

Benefit fraud and smuggling are not what FactCheck thinks of as “tax evasion”.

We tried to clarify what exactly is included in these figures and HMRC told us: “We have never said these cases were all tax evasion.”

Then what about this document, entitled Tackling Tax Evasion, which says on the opening page: “A total of 540 people were convicted of tax evasion in 2012-13″?

Who are the people being prosecuted: super-rich CEOs defrauding the state of millions, or hairdressers and builders? Again, we don’t know for sure, but tax industry insiders have said they think the taxman is increasingly prosecuting “the kind of tax evaders it would have previously seen as small time”.

In fairness, prosecutions are only one measure of success for the taxman, and the same law firm quoted here, Pinsent Masons, has noted that HMRC is bringing in more revenue from investigations into large businesses and the super-rich.

How does this compare to the problem of benefits fraud? A lot more welfare cheats are prosecuted – more than 9,800 in 2012/13.

But the money lost to the state from these different types of crime doesn’t really compare.

The Department for Work and Pensions estimates that £1.2bn was lost to benefits fraud in 2013/14, or 0.7 per cent of total benefits spending.

That’s the same amount as the year before, it’s a lot less than is lost in other developed countries – according to this study – and it’s less than the £1.5bn NOT paid out to people who are eligible for various benefits but don’t claim them.

By contrast, HMRC’s most recent estimate of the annual “tax gap” – the money lost to the state through people not paying as much as they should – was £34bn.

“We have saved over £100bn more than would have been expected through getting back tax that should have been paid.”

“We have saved over £100bn more than would have been expected through getting back tax that should have been paid.”

This is another claim that originates from HMRC and is now being repeated by other government departments. We think it’s dubious.

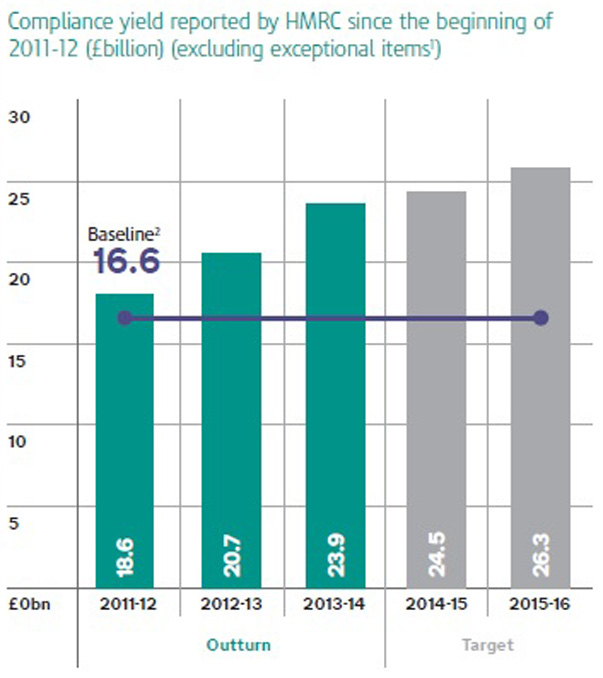

What HMRC are doing here is adding up ALL the money brought in through its “compliance” work – which includes efforts to combat avoidance and evasion – from 2010/11 to 2014/15. It adds up to just over £100bn.

The figure for 2014/15 is obviously still just a projection, so it’s not quite right to say that “we have saved” this money already.

But the real problem is the phrase “£100bn more than would have been expected”. That’s only true if what we expected was zero.

But clearly, one of the taxman’s central functions is to fight tax avoidance and evasion. They were already doing this work before the coalition came to power.

In fact HMRC agreed with the Treasury that the baseline to measure its efforts under this government should be a revised figure of £16.6bn in 2010/11.

It seems more natural to us to count the money raised over and above this baseline as “additional” revenue attributable to recent government policy.

If we do this, the “extra” money over five years is just over £21bn, not £100bn.

Perhaps we’re splitting hairs. Why not stop carping and just spend £100bn on thousands of new schools and hospitals or whatever?

Actually, it’s not as simple as that because, as we found last week, this isn’t really money in the bank. It’s a theoretical sum made up of complex projections of revenue, much of it will actually be banked at some point in the future:

The verdict

One straightforward factual blunder from Mr Duncan Smith: not all those 2,600 people went to jail, and evidently they weren’t all prosecuted for tax evasion.

The £100bn figure quoted by Mr Duncan Smith is endorsed by HMRC, but the continued use of words like “more” and “additional” around this figure seems misleading to us.

If FactCheck started working an extra hour a day, we wouldn’t say we’d done 45 hours of overtime at the end of the week. We might say we’d done a bit more than expected.

In fairness, we ought to note that if HMRC’s figures are right, the taxman has substantially increased the amount of money it brings in from anti-avoidance and evasion, and it is successfully prosecuting more people than ever for various offences.