Are bankers worth their weight in gold?

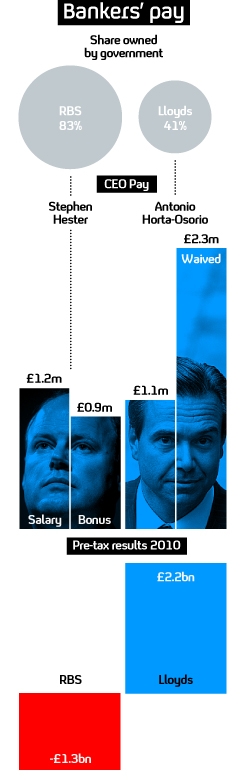

As fury erupts over the £963,000 bonus awarded to Stephen Hester, chief executive of the state-owned RBS, Channel 4 News delves into the mysteries of bankers’ pay.

Even the parents of Royal Bank of Scotland’s Chief Executive Stephen Hester think he is paid too much, or so he told The Guardian. But they are not on the remuneration committee which sets his level of pay.

Despite the efforts of government, most recently Vince Cable’s recommendations on curbing executive pay and high-profile reports such as that from the High Pay Commission, the multi-zero pay levels for top financial sector employees continue to appear in headlines.

The secrecy surrounding the pay of the executives of top companies, usually banks, is almost impenetrable. In the course of researching this article, Channel 4 News approached several organisations including head-hunters and the British Banking Association, only to be told that they would not be commenting on the blisteringly hot political question, “Why do banking executives merit their remuneration packages?”.

So aside from poring over the guidelines issued by industry regulator the Financial Services Authority (click the above link) what do we know about how bankers’ pay is decided and why it is comparatively high?

Upheaval

Dr Roger Barker, head of corporate governance at the Institute of Directors (IoD) told Channel 4 News what he thinks at least partially explains pay levels: “There are several things at play here. A lot of people who sit on remuneration committees are former executive directors and it is their job to make decisions on the pay of CEOs or their equivalent. They themselves have experienced a certain level of remuneration and they they may think that is the norm.

“Second, if you’re an exec on these boards of multinational companies, if your CEO walks out of post, it could cause huge upheaval for example in the markets.

“So they may seek to stop that from happening by agreeing to generous remuneration payouts which, although significant to the man in the street, are not substantial relative to the overall size of the company’s revenues and profits.”

Across the board, this year, chief executives can expect average remuneration of over £4.5m ($6.9m). Pay for top-tier employees grew by over 300 per cent between 1998 and 2010.

Click here to see the Financial Services Authority’s advice on financial sector pay (PDF)

And according to the High Pay Commission’s report from 2011, “in the last year alone, as economic growth has slowed, executive pay in the FTSE 100 rose on average by 49 per cent compared with just 2.7 per cent for the average employee,” illustrating the importance companies put on the position of their executive teams and there has been a drive to link pay to performance.

Stardust individuals

But as Kayte Lawton, senior research fellow from the Institute of Public Policy Research (IPPR) points out, this may be making the situation worse. “In trying to relate pay to performance, pay deals have become much more complex,” she said.

“It’s not clear that linking pay to performance works in practice. It also creates the impression that a small number of individuals are responsible for the success of the company – the idea that you have to pay a lot of money for certain “stardust” individuals.”

And Dr Roger Barker from the IoD admits the IPPR has a valid point insofar as the success of a company should not be entirely put down to the efforts of the executive team.

The former head of the CBI, Richard Lambert, also pointed out that the use of consultancy firms to set pay is as yet unknown. He questioned whether such companies might be inclined to push pay levels higher and suggested that firms should disclose their use of consultants for this purpose.

More recently he dared question received City wisdom that top executives add as much value to a company as may be thought.

He also made an almost heretical observation for those who say executives are paid such high sums because otherwise they will go elsewhere; no-one is irreplaceable.

-

Latest news

-

Yungblud launches his own affordable music festival5m

-

Why these Americans want to quit their state9m

-

Company behind infected water outbreak are ‘incompetent’ says local MP5m

-

Israeli forces push deeper into Northern and Southern Gaza4m

-

India’s ‘YouTube election’: Influencers enlisted to mobilise youth vote6m

-