UK economy shrinks by an unexpected 0.5 per cent

The economic recovery of the UK suffers a blow, with a shock contraction of 0.5 per cent in the last three months of 2010. It means a double-dip recession is on the cards, says Faisal Islam.

The latest economic figures revealed that Gross Domestic Product (GDP) shrank by 0.5 per cent in the final quarter of last year.

Severe weather during the October to December months hit economic activity, the Office for National Statistics (ONS) said.

Economists had warned that the snow and ice that brought much of Britain to a halt for weeks would affect figures, but growth was expected to be between 0.2 per cent and 0.6 per cent.

A spokesman for the ONS said that, without the weather, GDP output in the fourth quarter was still likely to have been flat at 0 per cent.

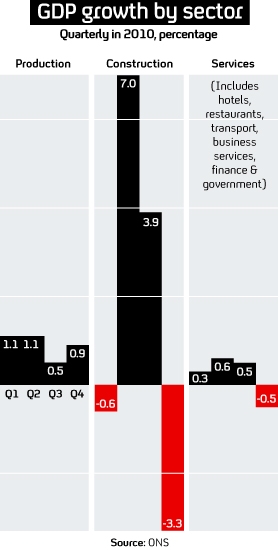

The decline in GDP – the first since the third quarter of 2009 – was driven by a 0.5 per cent drop in the key services sector, which makes up more than 75 per cent of the total economy. Construction, which was growing in the second and third quarters of 2010 plummeted 3.3 per cent.

The Chancellor, George Osborne, blamed the bad weather for the poor economic figures.

“These are obviously disappointing numbers, but the ONS has made it very clear that the fall in GDP was driven by the terrible weather in December,” he said.

“We will not be blown off course by bad weather.” Chancellor George Osborne

“We have had the coldest weather since records began in 1910 and this has clearly had a much bigger impact on the economy than anyone expected.

“It’s notable that sectors of the economy that are less affected by the poor weather, such as manufacturing, continue to perform strongly, helping to rebalance our economy.

“There is no question of changing a fiscal plan that has established international credibility on the back of one very cold month. That would plunge Britain back into a financial crisis.

“We will not be blown off course by bad weather.”

But our Economics Editor, Faisal Islam says that, while the decline is clearly weather-related, it is also influenced by the Chancellor’s “gamble” on implementing the austerity plan as an “insurance policy” against national bankruptcy.

“Today’s number – for a Chancellor who inherited an economy growing at a quarterly rate of 1.1 per cent to launch tax rises and spending cuts as the economy contracts – markedly increases that gamble,” he writes.

“It weakens the glue of necessity that has enabled Lib Dems to change their minds on many policies. And with prices and taxes rising too, it means that double dip recession is on the cards.”

Faisal Islam writes: If the government approach to this is: "Move along now, nothing to see here", then it sounds staggeringly complacent.

On the pace and timing of deficit reduction, there surely is a debate beyond the moronism of: "We were going bankrupt in May" and "There is no alternative".

The Government is trying to present its judgement as a necessity. The only necessity on cutting early and fast is a political one: the need to blame the previous Government for the pain, and to be in a position to offer tax cuts in 2014 - before the election. Necessity negates the need for a mandate, it seems, particularly for the Lib Dem Cabinet mindbenders.

Reasonable people - including the Cabinet Secretary - feel preparing a Plan B would be a sensible strategy. (As it happens that work was, I understand, done in response to a possible Eurozone collapse.)

It isn't plausible to say the eradication of growth had nothing to do with the cuts, even if one does acknowledge that the steep decline clearly is weather-related.

Read Faisal Islam's blog in full

With the 0.5 per cent drop in the fourth quarter, total growth in 2010 stands at 1.4 per cent, far below analysts’ forecasts.

The figure, which is a preliminary estimate and subject to revision, will raise serious concerns over the strength of the economy as it enters the age of austerity and its ability to withstand the coalition Government’s deficit-busting austerity measures.

The dramatic contraction in GDP will seriously damage prospects for the economy over the next year, as George Osborne rolls out his £81bn package of spending cuts – which include hundreds of thousands of public sector job losses.

‘Reckless plan’

Ed Balls MP, Labour’s Shadow Chancellor of the Exchequer, in response to today’s GDP figures, said the government needed to “rethink their reckless plan to cut”.

“It is clearly a matter of great concern that Britain’s economic recovery has now ground to a halt,” he said.

“As the independent Office of National Statistics has confirmed, even after the effects of December’s bad weather, the UK economy saw no economic growth in the final quarter of 2010.

“With families and businesses already facing both rising unemployment and rising inflation, the fact that the economy is now shrinking means the Conservative-led Government’s claims to have saved the economy and secured the recovery will ring very hollow indeed.”

Labour MP Ben Bradshaw said that the figures were a consequence of the coalition’s “ill-considered economic policies”.

Mr Bradshaw tweeted: “When in doubt blame the weather! It didnt start snowing til December and these provisional figures are weighted to Oct/Nov”.

Borrowing lower than expected

The Chancellor received some relief from data released by the ONS, revealing a lower-than-expected increase in Government borrowing in December – of £16.8bn – which will ease pressure on the creaking public finances.

The figure, which excludes financial interventions by the Government, was a marked decrease on the £21bn borrowed a year earlier, according to the Office for National Statistics.

Although heavily affected by the weather, the UK’s shockingly bad fourth quarter GDP figures raise serious concerns over whether the economy is in a strong-enough position to withstand the fiscal tightening. Jonathan Loynes, chief European economist at Capital Economics

Total public borrowing for the year to date now stands at £118.4bn, the ONS said. The Government’s target is £149bn for the financial year.

‘Shocking’ figures

Jonathan Loynes, chief European economist at Capital Economics, described the figures as “shockingly bad”.

“Although heavily affected by the weather, the UK’s shockingly bad fourth quarter GDP figures – showing a 0.5 per cent quarterly contraction – raise serious concerns over whether the economy is in a strong-enough position to withstand the fiscal tightening,” he said.

Mr Loynes expects the economy to rebound in the current quarter, as it did after poor weather in the fourth quarter of 2009, but other adverse forces, not least the impact of the latest VAT hike, could limit the size of the bounce.

My Loynes told Channel 4 News it was difficult to compare the figures on a global scale because the other major economies are yet to publish their figures.