Soaring car insurance costs to be examined

With an average 40 per cent hike in car insurance premiums over the 12 months to May, the Office for Fair Trading is to examine whether any competition or consumer issues need to be addressed.

The Office of Fair Trading (OFT) has issued a “call for evidence” as it looks to establish if any competition or consumer issues need to be addressed to improve the car insurance market.

The “shoparound average” for annual comprehensive car insurance cover rose by 40.1 per cent to £892 in the 12 months to March 31, according to the AA’s British Insurance Premium Index (BIPA). The rise has hit the 17-22 and 40-49 age groups the hardest.

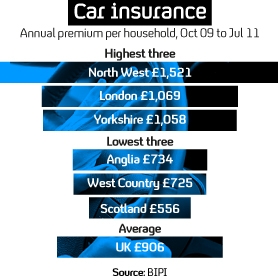

The OFT plans to examine evidence on the role of price comparison sites, regional premiums “hotspots” such as Northern Ireland, the use of approved repairers, and the sale of “extras” such as legal protection.

Rising bills

The Association of British Insurers (ABI) says it sees the call for evidence as an opportunity to highlight the increasing pressures faced by insurers.

General Director Otto Thoresen said: “Rising claims costs from personal injury claims and excessive legal costs, insurance fraud and uninsured driving, coupled with lower investment returns in recent years, have unfortunately led to rising motor insurance bills for many customers.”

Fraudulent and personal injury claims have increased by 30 per cent since 2009. Personal injury claims have risen 72 per cent between 2002 and 2010. For every £1 of compensation paid out, another 87 pence is paid to claimant lawyers, who every day are paid £2.7m through insurance premiums. And every year there are 40,000 fraudulent motor insurance claims, worth £466m.

In addition, the cost of compensating victims of accidents involving uninsured drivers – every one in 25 cars is uninsured – amounts to £500m a year.

Uninsured cars

A spokesman for the AA told Channel 4 News that the number of uninsured cars on the road has been falling in recent years, but still there are a “shocking” 1.4 million uninsured cars on the UK’s roads. While he acknowledged rising premiums risked some drivers choosing to drive uninsured, he said: “Most people are aware of the likelihood of being caught.”

He added: “The motor insurance industry has not been profitable for the last 16 years.”

Otto Thoresen said the private motor insurance industry is “doing everything possible to reduce costs” by tackling “compensation culture” and setting up an insurance fraud register.

The watchdog says this is a preliminary enquiry to establish whether there are any consumer or competition issues which need to be investigated more fully. Evidence will be gathered over the next five weeks, and the findings published in December.

-

Latest news

-

‘I violated my moral compass working for Trump,’ former lawyer testifies3m

-

Working class creatives in film and TV at lowest level in decade5m

-

Israeli police investigating attack on Gaza aid convoy4m

-

Biden announces major tariff increase on Chinese-imported green tech3m

-

‘If NHS can afford it, people with obesity should have Semaglutide,’ says weight loss expert5m

-