‘Generation rent’ – trapped with no hope of buying a home

Ciaran Jenkins

Data Correspondent and Presenter

Ciaran Jenkins

Data Correspondent and Presenter

The government is intent on helping people onto the housing ladder. But for some, property ownership doesn’t come into it. Their dream is to be able to afford to rent a flat, not just a single room.

If there was one thing “generation rent” did not need, it was for rents to go up. It is a generation already defined by its inability to scale the property ladder. Now, for some, even renting a home may seem out of reach.

According to the National Housing Federation, rents have increased more than 40% in some areas over the past two years. And it is set to get worse. Rents, already at an historic high, are expected to rise again. Market forecasters, Oxford Economics, are predicting hikes of 5% each year until 2020.

As a result, generation rent is downsizing. And as demand for smaller, cheaper accommodation grows, investors and entrepreneurs are rushing to cash in.

Micro-apartments

A property developer from China is banking on the future of the rental market being tiny. In floor space at least.

He’s hoping to attract priced-out tenants with a new development of micro-apartments. Planning permission has been secured for 160 one bedroom flats starting at just 18 square metres, less than a third the size of a squash court.

Surprisingly, the micro-apartments will be located not in one of the UK’s major cities, but in Oldham.

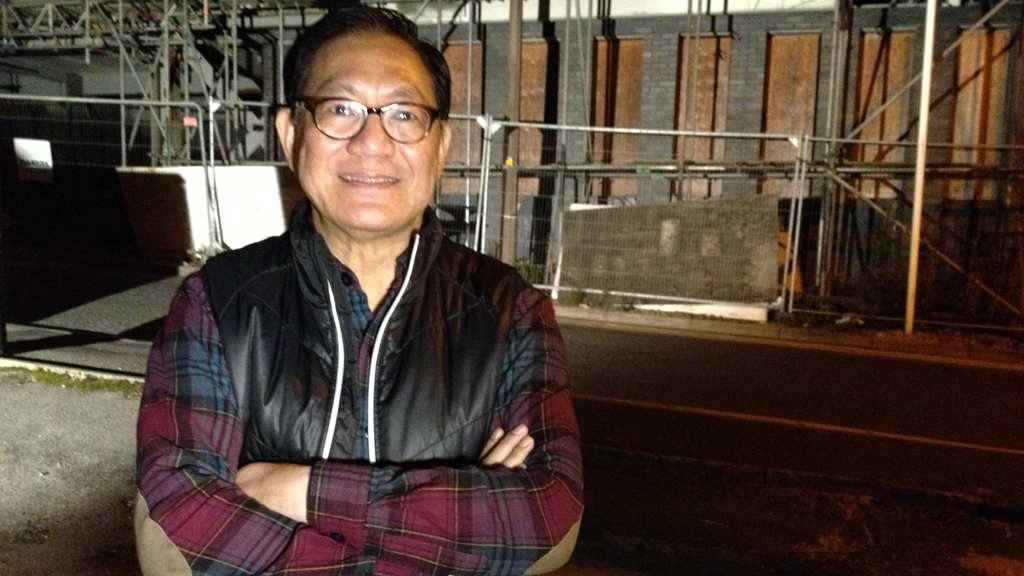

“Do you really think Oldham’s ready for this kind of living?” I ask Dr Francis Liu, Chief Executive of G-Suite Holdings, the Chinese company behind the project.

“Yes, I come from Hong Kong and I know people are looking for quality buildings with everything in,” he says.

“The trend in New York and San Francisco is for tiny micro-apartments. The idea is coming from those people.”

I put it to Dr Liu that unlike San Francisco and New York, Oldham has plenty of land ripe for development, which could easily house decent-sized homes.

“The key is affordability,” he replies. “You don’t have to be an accountant to work it out. The smaller size will result in lower rental.”

But what does Oldham gain from a development like this?

None of the apartments have been earmarked as affordable housing, and local first time buyers appear not to be the developers’ target market.

Instead, the apartments will be sold to investors in the Far East. They are being promised an 8% return on their investment.

“Micro means small,” says Dr Liu. “Boutique means it has some style. Apartment means self-contained. You can have everything within a tiny space, but without giving up any luxuries.”

Except, of course, the luxury of space.

Rent-to-rent

But then the young adults of Generation Rent are increasingly prepared to sacrifice square footage for affordability.

It’s something Doncaster-based entrepreneur Kim Stones realised to his advantage a few years ago. He claims to be a pioneer of the profitable property market niche, “rent-to-rent”.

“We basically take a property from a landlord, pay him a long-term guaranteed rent and then sublet it on a room by room basis. That’s how we make our margin,” Kim explains.

Kim’s strategy is to adapt living spaces in order to maximise profits when the property is sublet. He rents three bed properties from landlords and sublets them as five individual rooms by turning sitting rooms and lounges into bedrooms. He is at pains to point out that he follows all relevant regulations.

“We’ve got 23 rent-to-rents,” says Kim. “Our target is a minimum £400 a month profit on any property, and we do have properties that make £1000 net profit a month.”

On his website, Kim claims to earn around £6,000 a month from tenants in receipt of housing benefit. However, he says young local workers make up two thirds of his client base.

“The sales market over the last five years has been dormant,” he says. “It just means demand for rental, whether it’s rooms or houses, has increased.”

“Somebody who is 22 or 23 years old, they don’t want to live with mum and dad anymore, they want to move out, but they can’t afford it.”

To illustrate the point, Kim takes me to meet Daniel Elder. Daniel is 21 years old and works in a warehouse in Doncaster. The sum of his property ambitions are to one day rent a place of his own.

“This room here is my personal space, it’s the only thing I’ve got really,” he says.

Doesn’t he dream of owning a home? The government has, of course, rushed forward its Help to Buy scheme. It is available to anyone with a deposit with a deposit of 5% or less, including first time buyers.

“Nah, not really,” says Daniel. “It just wouldn’t be affordable. I can’t even consider it.”

-

Latest news

-

Boy with profound learning disabilities reaches out of court settlement after abuse in residential school7m

-

India election: Modi rivals hit by string of raids and arrests7m

-

Can UK’s abandoned mines be used to build a greener future?5m

-

Sycamore Gap: Man pleads not guilty to felling iconic tree2m

-

‘Child poverty has not fallen since Tories came in’, says Gordon Brown5m

-