Hung parliament prompts stock market fall

Updated on 07 May 2010

Tory-Lib Dem negotiations will centre around plans for the most severe budget since the 1970s, reports Faisal Islam - and for the markets, that is unchartered territory.

The indecisive result - with Conservatives falling short of the winning line - added to continued fears over the economic situation in Greece to weigh on the London market.

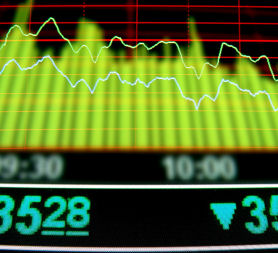

After a 100-point fall during a turbulent opening spell, the Footsie was 61.1 points lower to 5199.9 later, while investors on Wall Street showed a muted response to positive economic news following yesterday's dramatic 3.2 per cent fall.

The Dow Jones Industrial Average was flat despite a report showing employers added 290,000 jobs - the most added in one month in four years - as traders were still spooked by yesterday's plummet.

Greece still played on investor's minds amid moves by European leaders to convince fearful markets that the Greek debt crisis won't spread to other countries and derail the continent's currency and economic recovery.

Political uncertainty saw the pound fall against the euro and to a year-low below 1.45 against the dollar. But worries that political deadlock would lead to delays in tackling the UK's yawning deficit were allayed somewhat after Liberal Democrat leader Nick Clegg said the party with the most votes and seats - the Conservatives - should have the first stab at trying to form a Government.

Investment banker Alastair Newton told Channel 4 News: "The critical point is likely to be Monday. If we think back to 1974, a hung parliament, a result over the course of a weekend, no real problems on Monday at all. But of course the world was very different then...

"We could see the markets reacting quite seriously on Monday if we don't have some clear signs by then of a stable government."

Meanwhile, Conservative David Cameron signalled a potential deal, promising to work for "strong, stable government". Sterling was later at 1.46 against the greenback and 1.15 against the euro.

The weakness of the pound meanwhile sparked inflation fears, as well as factory gate prices rising at their fastest pace for 18 months. Financial stocks were hit heavily yesterday but saw a mixed session today.

Part-nationalised Royal Bank of Scotland fell 3.83p to 44.4p or 8 per cent, although it narrowed losses to £248m for the first three months of 2010 and said turnaround plans remain "on track".

HSBC fared better - adding 14.7p to 643.1p after first quarter profits "comfortably ahead" of last year and an improving position on bad debts.

Support services group Capita was among the biggest Footsie casualties, down 48p to 768.5p or 6 per cent after a downgrade from brokers at Shore Capital.

Miners saw a stronger session as the sector stepped up its fight against the Australian super-tax announced this week. Rio Tinto and BHP Billiton gained 81p to 3187.5p and 30.5p to 1903p respectively.

British Airways was a faller however after the airline's cabin crew overwhelmingly rejected an offer aimed at ending their long-running dispute. Shares dipped 8.7p to 195.9p.

Rival easyJet dropped 7p to 436p in the FTSE 250 after it said it had suffered 750,000 cancellations as a result of the Icelandic volcanic ash cloud.

Elsewhere in the second tier broadcaster ITV dropped 2.8p to 58.2p or more than 6 per cent after new boss Adam Crozier reported rising revenues but warned the outlook for the latter part of 2010 and early 2011 looked tough.