FactCheck: the 10p tax saga

Updated on 24 April 2008

For weeks the prime minister insisted - in private at least - that no-one would be worse off. Was there ever any truth in that line?

The claim

"No-one will be worse off."

Gordon Brown, meeting of Labour's National Executive Committee, 20 March 2008.

The background

More than a year ago, in his final Budget as chancellor, Gordon Brown announced that he would change tax rates on wages.

Central to it was the reduction of the 22p tax band to 20p.

It was a classic piece of parlianmentary theatre; at once the future PM was stealing the oppostion's tax-cutting thunder but also appearing to be helping the less well off.

Somewhat tellingly, perhaps, Brown did not mention another key part of this change in his speech. Namely, his plan to abolish the 10p tax rate on the first £2,230 of earnings, meaning everyone would pay a 20 per cent rate after the first £5,435.

By and large the changes were forgotten until the new tax rates kicked in this April, when some people complained that their wage packets had shrunk.

The subsequent dissatisfaction fed back to MPs through mailbags and inboxes, and campaigners working the doorsteps in the run up to elections.

In public, Brown has avoided specific claims regarding the impact of the tax changes, instead favouring vague statements such as "since 1997 people on low incomes are significantly better off".

(He used a similar form of words in his interview last week with Jon Snow, for example.)

Although Brown has chosen his words carefully in public, it appears he has been a lot more bullish in private.

Indeed it was only when he and current chancellor Alistair Darling announced a package of measures to address the inequities, that the government tacitly conceded there were indeed losers.

But in more private surroundings in the last few weeks it appears he had come out fighting in favour of his tax overhaul.

A Labour MP present at a meeting of the Parliamentary Labour Party (PLP) three weeks ago, when the 10p issue was raised, told FactCheck: "As far as I can recall he [Brown] said that no-one would lose out from the changes - that's how I remember it."

Ann Black, a member of Labour's National Executive Committee (NEC), was even more illuminating on Brown's true feelings.

Referring to a meeting of the NEC on March 20, she told FactCheck: "He [Brown] said that no-one would be worse off because of the 10p changes - I sat there shaking my head.

"Then he invited people to send in him their pay slips to prove him wrong. It was quite clear that he was being specific."

So, although Brown has chosen his words carefully in public, it appears he has been a lot more bullish in private.

But was he ever right to say no-one is "worse off"?

The analysis

As the debate raged earlier this week most critics of the tax change pointed to low income workers unable to claim benefits as the main losers from the 10p cut.

If you have dependent children, are sick or disabled, are caring for someone, are over 60, recently bereaved, pregnant or recently gave birth - then there are tax credits and allowances you can claim for.

However, there are people who don't fit into any of those categories, most notably under 25s ineligible for tax credits, those who retired early, and part-timers working insufficient hours to get tax credits.

FactCheck got its calculator out to check.

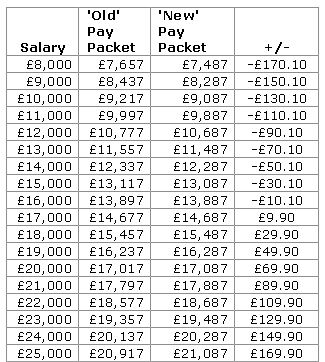

Ignoring any National Insurance contributions, which have remained largely stable, under the old 10p tax system someone earning £8,000 would take home £7,657.10

Under the new system £8,000 a year would leave you with £7,487 - £170.10 out of pocket compared to the previous year.

The trend continues as of below, eventually levelling off and going the other way. But it's clear Brown was wrong: some people are worse off if they cannot claim benefits and credits to top up their income.

It's only fair to point out that Brown's last Budget gave an extra £3bn in pension allowances, an increase in the working tax credit, and an increase in the child tax credit.

That was followed by another £1bn of support for increases in the child tax credit.

So if some people are worse off, then how many?

The Tories are keen to say that 5.3 million households will be worse off under these changes. And today they said 260,000 people in Wales alone would be left worse off due to the 10p changes.

It is a claim that many in the Labour Party have denied, and it's understood that Brown in particular is furious with what he sees as a hugely inflated figure.

Lucy Powell, Labour's Parliamentary Candidate for Manchester Withington, trotted out a familiar put down in relation to the Conservative's jibe.

She said: "The claims of the Tories that five million people are worse off by as much as £500 are wholly incorrect."

However, it's worth looking at what the Treasury is saying about the costs of this change to work out the scale of its impact. Alistair Darling says it will cost £7bn to reverse the 10p tax change.

Yet five million times £500 is £2.5bn. Suddenly the Tory numbers don't seem so large.

It is also worth bearing in mind that £1.2bn a year is left unclaimed in tax credits.

So while Brown will assume that a lot of people (those that are eligible for benefits) will fill out a 24-page claim form to get back some money, the reality is that hundreds of thousands won't. And they will be worse off as a result.

The verdict

A trawl of the Downing Street lobby notices shows Brown's standard public response to questions about whether he thought the 10p change had left anyone worse off was to say "since 1997 people on low incomes are significantly better off."

It hinted at a new uncertainly over the precise impact of the 10p change. The promise of new allowances and credits is witness to that.

It is clear that some people will be worse off, and Brown's bold statements to the PLP and NEC were wide of the mark.

FactCheck rating: 4.5

How ratings work

Every time a FactCheck article is published we'll give it a rating from zero to five.

The lower end of the scale indicates that the claim in question largely checks out, while the upper end of the scale suggests misrepresentation, exaggeration, a massaging of statistics and/or language.

In the unlikely event that we award a 5 out of 5, our factcheckers have concluded that the claim under examination has absolutely no basis in fact.

The sources

Downing Street Press Briefing

Telegraph: how Labour can get off the hook on 10p tax

Citizen Advice Bureau: Benefits and tax credits for people in work

The Guardian: about Lucy Powell

HM Treasury: Chancellor of the Exchequer's Budget Statement

Your view

You've read the article, now have your say. We want to know your experiences and your views. We also want to know if there are any claims you want given the FactCheck treatment.

Email news@channel4.com

FactCheck will correct significant errors in a timely manner. Readers should direct their enquiries to the editor at the email address above.