Lenders of last resort?

So-called “payday loans” are facing increasing criticism from campaigners for their uncapped interest rates and ease of access but what are the alternatives? Channel 4 News investigates.

As Christmas approaches, for some people, so does the need to find extra cash to fund the festivities. Financial stress does seem to become more acute at this time as people worry about not being able to give their loved ones presents or find that higher bills at the same time as extra Christmas-related spending stretches their bank account a step too far.

Financial website moneysupermarket.com said enquiries about payday loans have been “continually growing” in the last few months, with a 23 per cent increase in November on the previous month.

‘Not a continuous credit facility’

Payday loans (so-called because they are meant as a stop-gap measure until payday) are controversial because although they are designed as a short-term measure, their seemingly easy availability makes them a tempting option for people who might be better suited to other forms of credit.

If you can’t afford it now, it’s most likely you won’t afford it later. Debt counselling charity CAP

One of the more well-known providers, Wonga.com told Channel 4 News its loans are “not designed as a continuous credit facility” and used in the short-term by people with the means to pay them off, they are a viable credit option.

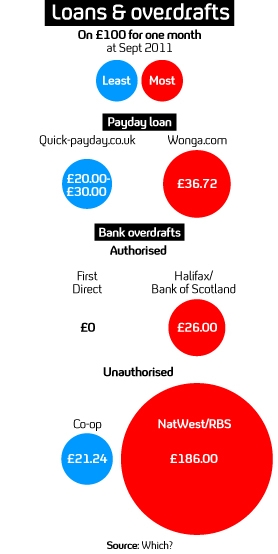

Factcheck: Are payday loans the cheapest option?

But the Consumer Credit Counselling Service told Channel 4 News payday loans should only be used as a last resort: “They are an extremely expensive way to borrow and should be avoided wherever possible. The danger is the temptation to ‘roll over’ the loan into the following month, which means that you can end up paying back far more than you originally borrowed.”

The charity advises before considering taking one out, people should look at their wider financial situation to see why you need credit.

“If you find yourself turning to payday loans on a regular basis, you should seek free advice from a debt charity such as CCCS as early as possible.”

‘Clare’ got into serious debt when she took out payday loans when her husband fell ill

“You can so easily get yourself into a situation where you’re digging yourself into a hole. The adverts are on the TV all of the time, it’s a real temptation. I took out a loan when my husband was ill. I had to take time off work to look after him so the money wasn’t coming in but the bills still needed to be paid and these loans can be in your account in ten minutes.

“The first one I took out was for £500 but by the end of the month I found I couldn’t pay it off plus the interest so I went to another company and took out a loan for £1,000 then the next month when I couldn’t pay that, I took out another one for £1,500 plus interest.

“When my husband died, I had the grief to deal with but also this debt and the company kept ringing me up and texting me to get their money. I know it was theirs to get, but with that and my husband’s death it was so difficult to cope.”

Alternatives

As well as bank loans or even some credit cards there are other options if you genuinely need credit.

Credit unions

Co-operative, ethical and community-based, credit unions have been around for many years and savings with them are protected under the financial servies compensation scheme. You can save or get loans from them and they operate within communities or some professions such as the police.

The umbrella body for credit unions, ABCUL, says British credit unions have been growing solidly throughout the past 10 years, with a 300 per cent increase in assets and savings and 200 per cent increase in membership between 2001 and 2010.

Legislation has recently been passed which will allow them to expand their activities. Some of the larger unions offer financial services comparable to high street banks but a drawback is the services they offer can be limited by the number of members.

But as Sarah Pennells, editor of the Savvy Woman website explained to Channel 4 News their basis in communities is a big selling point: “I think that people like the idea of borrowing from individuals rather than the banks – there’s often a real feeling of people helping each other.

“There is some element of responsibility here too – they aren’t going to try and get you to to borrow lots of money and their loan rates are pretty low.”

Peer to peer lending

This is where people with cash to lend are paired with people who need credit. Sarah Pennells says such schemes appeal to some borrowers who would otherwise use payday loans: “If you’re going to a payday lender because you like the anonymity and you don’t have a poor credit history then you might want to instead look at peer to peer lenders like Zopa.

“They’re good for people who have a good credit history or, in Zopa’s case, those who are just starting out and who don’t have much of a credit history at all.

“But if you have a poor credit record, you probably won’t get a loan.”

Peer to Peer lending is also not covered under the financial services compensation scheme, so if the agency goes bust as one did recently, borrowers will have to find other ways to get their money back.

CDFIs

Community Development Finance Institutions (CDFIs) may also be an option for some. They are mostly based in the UK’s most disadvantaged communities and lend money to those who struggle to get loans from high street banks. But as Sarah Pennells says, they too are thin on the ground:

“These are aimed at those people who are financially excluded. They not only provide loans, they also give financial advice and education. I think this is a good idea because often what people need is financial advice, not more money.”

And education is one thing which will help prevent people making poor financial decisions in the first place.

Debt counselling charity Christians Against Poverty which helped ‘Clare’ sort out her debt problems and offers financial advice told Channel 4 News the best way to avoid getting into debt is to avoid credit: “Every day we see the grim reality of what debt does to families: relationships broken, homes repossessed, parents struggling to feed and clothe their children.

“In fact, when they first get in touch for help, more than a third of our clients say they are considering suicide as a way out. When it comes to payday loans, our message is clear: If you can’t afford it now, it’s most likely you won’t afford it later when interest charges are piled on top.”

-

Latest news

-

Laughing Boy: New play tells the tragic tale of Connor Sparrowhawk5m

-

Sewage warning system allows some of worst test results to be left off rating system, analysis shows3m

-

Post Office inquiry: Former CEO didn’t like word “bugs” to refer to faulty IT system4m

-

Israeli soldier speaks out on war in Gaza12m

-

PM’s defence spending boost should be ‘celebrated’, says former Armed Forces Minister4m

-