No encore for HMV?

As HMV enters administration, Channel 4 News examines whether this is the end for the 92-year-old high street chain – or if it can live on.

Opened by composer Edward Elgar on Oxford Street in 1921, the “hope and glory” that heralded HMV’s arrival has been muted in recent years – the result of a mixture of poor economic circumstances, over-zealous expansion and internet shopping.

However, the announcement that Deloitte will be handling the administration of HMV’s portfolio of more than 239 stores does not mean the end for the high street retailer and the jobs of 4,350 employees.

HMV’s chief executive Trevor Moore said he was sure the business would survive in some form. “I’m confident that we will find a solution,” he said on Tuesday.

“We remain convinced that we can find a successful business outcome. We know that HMV is a well-loved brand, which has a high level of support amongst the public and we want to ensure that it remains on the high street.”

But what form a new HMV takes, what outcome there is for the workforce, and the impact it will have on the high street, remains to be seen. So what is the likely future for one of Britain’s high street household names?

How did it get here?

The story of HMV’s decline has been a familiar one. First of all there is the combined pressure on sales of music and DVD websites, such as Amazon, and supermarkets, such as Tesco, encroaching on the retailer’s previously safe domain.

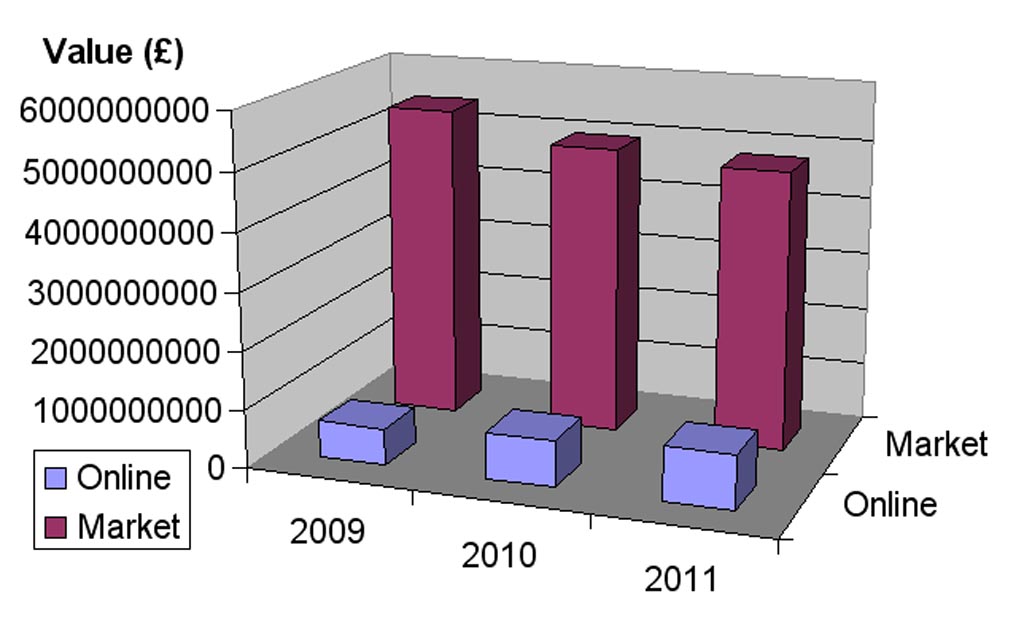

Data from the Entertainment Retailers’ Association (above, right) shows that online’s share of the entertainment market, comprising music, video and games, rose from 11.7 per cent in 2009 to 19.5 per cent by the end of 2011. Supermarkets accounted for 42.8 per cent by value of the sales of video in 2011, and 32.3 per cent of the sales of music.

HMV saw like-for-like sales drop by 13.6 per cent in 2011, and by 12.1 per cent in 2012. Last year it made a loss of £38.9m.

There is more to HMV’s troubles though. According to insolvency expert Mathew Ditchburn, a partner in Hogan Lovells’ real estate dispute team, the business was guilty of over expansion.

“It was one of the many high street retailers which took the costly approach which was to open as many shops as it could – that was the business model in the 2000s,” he said.

Cain on Culture: HMV - the tail that wags the dog

“They found they were too big and over-stretched in terms of their physical store portfolio.”

HMV has been in negotiations with its lenders after it announced it would was unlikely to be able to fulfil its debt obligations at the end of January.

RBS, one of the two lenders, said in a statement on Tuesday: “The banking group led by RBS and Lloyds Banking Group have provided significant support to HMV over the past two years, as it has sought to reshape and restructure its business in the face of extremely difficult trading conditions.

“Unfortunately, despite the best efforts of management, lenders and suppliers, it has not proven possible to avoid a formal insolvency process.”

What happens next?

The likely outcome from HMV is that the business and its best performing stores will be bought, but the worst performing stores will be closed.

Neil Saunders, managing director at retail consultancy Conlumino, said: “I think it’s a good brand with a good emotional connection and I think someone will want it. And someone will be interested in acquiring a rump of stores because there are some that trade profitably within the group.”

How many stores would be dropped in this scenario is unclear, but it could be easily imagined that a half of HMV stores would disappear from the high street.

Shopping centres love HMV because it provides a service as a ‘male creche’. Mathew Ditchburn

Mr Ditchburn said that the amount of stores that remain open will partly depend on negotiations over rent payments to landlords. He said a new owner for the business would keep the best stores and drop the worst, but would look for deals in order to keep averagely performing stores open.

He added that this could mean HMV stores in shopping centres are more likely to stay open than HMV stores on the high street.

“Shopping centres love HMV because it provides a service as a ‘male creche’,” he said. “If a female goes clothes shopping, the male can either choose to sit outside the changing rooms, or he can go and browse in HMV.

“HMV provides a service to shopping centres so they will be some goodwill on the part of shopping centres to keep HMV stores open.”

And closed stores?

Around 14.6 per cent of shops across the UK are empty, data from the Local Data Company says, and closed HMV stores will contribute to this. However, Mr Ditchburn says that HMV stores are often in good locations, at the centre of high streets, so will be attractive to other shop owners.

It is likely that £1 stores and other value retailers would be interested in taking over HMV stores. This sector is currently expanding, operating as it has contrary to other recession-hit retailers. It also looks for the larger than average shop size that HMV typically occupies.

Another option would be convenience store formats, such as Tesco Metro or Sainsbury’s Local, Mr Ditchburn said.

He also said that an online retailer, such as Amazon, could be interested in taking on some of the stores in order to provide a “click and collect” service – allowing customers to buy online and then pick up items in store.

@channel4news just finished working at @hmvnewcastle last week. best job ever, like one big family. absolutely gutted :(

— hannah warwick-soden (@horrorhannah) January 15, 2013

@channel4news I’m kinda sad… I have bought a number of albums and other bits from there… Most recently of which was merely yesterday.

— Bethany Johnson (@Rorru) January 15, 2013

@channel4news It was nice to be able to browse, as then I might find something which I would never have found otherwise…

— Bethany Johnson (@Rorru) January 15, 2013

@channel4news a great place to work, good employee benefitsgood environment, illegal downloading will be the end ofall similar outlets

— janine weaver (@JanineLove87) January 15, 2013

@channel4news I worked at Liverpool One briefly when in uni. Horrible. HMV is an overpriced supermarket with underpaid, overworked staff.

— chris bradley (@thechrisreport) January 15, 2013

I want my last HMV purchase to be the same as my first. Need the closure. Do you think they still stock the Aqua Album: Aquarium?

— Jack Whitehall (@jackwhitehall) January 15, 2013

hmv bankrupt. we may as well just give up on any medium that involves hard copy and get on with it. #sadtimes

— Professor Green (@professorgreen) January 14, 2013