How buy-to-let is back

The buy-to-let property market is back, thanks to the taxpayer. But there is a backlash against it, as Channel 4 News Economics Editor Faisal Islam discovers.

At the depth of the banking crisis and the recession, it was thought that the buy-to-let market would suffer. But of the nearly 1.3 million buy-to-let properties, fewer than one per cent were repossessed during the slump – and with an 11 per cent share of the mortgage market, buy-to-let is more popular than ever.

The buoyancy of this market is now causing problems for first-time buyers, who are chasing the same properties as buy-to-let investors.

First-time buyers

Ed Howker, the author of “Jilted Generation”, told Channel 4 News: “Unquestionably, the winners in the buy-to-let market are older people and those who have done buy-let. And the result is unfortunately we have a housing market that is not in any way providing for the needs of the next 20-30 years and of the next generation of people.

“There’s a very basic question which government has to decide on, which is what exactly is the purpose of housing? Now, you or I, probably most other people, would think the purpose of housing is for people to live in.

“But actually government, in the last ten years and it seems to continue, seem to encourage people to use housing as a way of speculating, and this is a massive social policy failure.”

How buy-to-let was bailed out, is back, and may be bad for Britain

The ability of banks to service this relatively new market was undoubtedly saved by the bailout of Britain's banks, writes Channel 4 News Economics Editor Faisal Islam.

Buy-to-let only formally started in 1996. Yet, remarkably, Channel 4 News has established that 56 per cent of buy-to-let mortgages ever lent in Britain now sit on the books of bailed-out banks.

Roughly half of the outstanding buy to let mortgage stock is currently being nursed by the State in some form. Bradford & Bingley and Northern Rock's joint £30bn BTL mortgage book is being slowly run off, in direct government hands from an office in London. And then astonishingly, in figures that the mortgage industry does not want you to see, that have been passed to me, about 65 per cent of buy-to-let lending in the year after the banking bust, was coming from bailed-out lenders.

Buy-to-let is a quasi-nationalised industry.

None of this would matter, if buy-to-let was unequivocally good for everybody. But it is not.

Read more on how the bounce back of the buy-to-let market

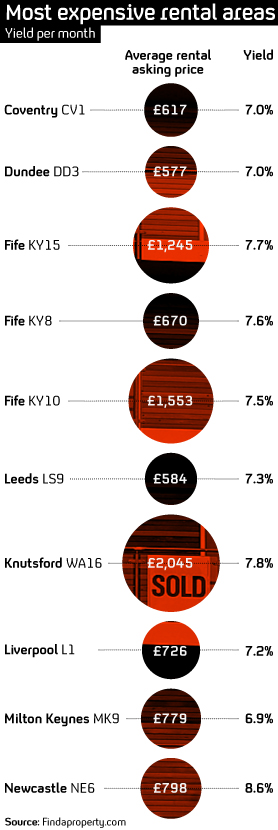

Rental yields differ around the country but provide considerably better returns at the moment than investors would see if they put their money in the bank because of low interest rates. The highest rental yields of 8.6 and 7.8 per cent are seen in Newcastle and Knutsford.

Bailed-out banks

More than 56 per cent of the entire stock of buy-to-let loans is on the books of banks that had to be bailed out by the taxpayer. Of new buy-to-let lending since the bust, an even higher percentage – around 65 per cent – is from bailed-out banks.

Newcastle, which has a big student population, is the British city that offers the highest rental returns for landlords. Andrew Pellegrino, a landlord in the city, said savers would receive a return of less than two per cent at the bank, but could make nine per cent from property.

“If you’ve got 50 grand or a 100 grand sitting in a bank account, or your folks have, the probability is sooner or later they’re going to get a bit sick of being short changed and put it in property.”

But David Steven, a policy analyst, said there were problems in the market.

“I think the taxpayer, the government, has a responsibility to look at whether the market is actually functioning in the long-term interests of the country,” he said.

“It certainly pushed house prices higher in the latter stages of the boom when speculators piled into the market. In the aftermath of the boom it seems to be pushing rental prices up when we need them to be lower.”

The Housing Minister, Grant Shapps, told Channel 4 News that there was a role for buy-to-let, but the Government recognised the aspirations of young people to buy their own homes. He said the housing benefit changes could have an effect on the buy-to-let market.

-

Latest news

-

Tim Booth of the band James’ on agism in music, topping the charts and AI6m

-

As India goes to the polls in the world’s largest election – what do British-Indians think?6m

-

Tees Valley: Meet the candidates in one of the biggest contests coming up in May’s local elections4m

-

Keir Starmer says public sector reform will be a struggle7m

-

Nicola Sturgeon’s husband Peter Murrell charged with embezzlement of funds from SNP1m

-