Labour says it wants to change the tax rules so “non-doms” can no longer avoid paying tax on their worldwide income.

Who are these people, how have they managed to get away with paying less tax than the rest of us, and will Ed Miliband’s plans work?

Who are the “non-doms”?

You can live in the UK but be “domiciled” in another country for tax purposes, for a number of reasons.

Government advice states: “Your domicile’s usually the country your father considered his permanent home when you were born. It may have changed if you moved abroad and you don’t intend to return.”

That simple explanation hides a multitude of sins. The law of domicile is an ancient, complicated and counter-intuitive thing.

People born abroad who intend to work in the UK temporarily then return to their country of birth might have a fairly straighforward claim to “non-dom” status.

But there are also stories of individuals being born in Britain, holding a UK passport and living here most of their lives while being treated as non-doms.

What’s the advantage?

Most of us are resident and domiciled in the UK. So we are liable to pay tax on the income and capital gains that we make in this country and anywhere else in the world.

Non-doms have the right to pay tax only on income and gains actually brought (“remitted”) to the UK.

That could be a massive advantage if you have substantial assets held in low-tax jurisdictions outside this country – this will stay out of the hands of the British taxman.

How many of them are there?

It has been suggested that millions of UK residents could qualify for non-dom status, though relatively few choose to do so.

The figure of 116,000 non-doms resident in Britain has been widely bandied about today, but this needs a bit of unpacking.

The latest figures given to FactCheck by HMRC are as follows:

The number appears to have gone up significantly under the previous Labour government. HMRC have said there were 83,000 non-doms in 1997/98, rising to a high of 140,000 in 2007/08.

These are people who ask the taxman to treat them as non-doms. But not all these people claim the tax advantage that goes with the status.

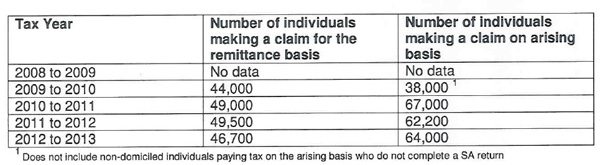

A Freedom of Information inquiry from Mark Davies and Associates – tax advisers who specialise in non-doms – suggests that less than half make a claim to be taxed on the “remittance” basis (the figures appear to be slightly out of date, so the totals don’t match the numbers above):

There’s another twist. In 2008 a charge was introduced for people resident in the UK for at least seven out of the previous nine years.

The coalition increased the fee. Now non-doms who want to keep their tax privileges have to pay between £30,000 to £90,000 a year, depending on how long they live in the UK.

Only about 5,000 non-doms a year pay these charges:

In 2012-13 non-doms paid £226m in remittance basis charges to the Exchequer.

So will we get more out of non-doms under Labour?

Nobody really knows, as we don’t know how wealthy non-doms would react to Labour’s changes.

It seems reasonable to assume that non-doms only pay for the privilege of keeping their tax privileges because it’s worth their while.

So presumably people who pay those annual charges have substantial assets abroad that would now be taxed, so there would be a win for the exchequer.

On the other hand, if all those people left the UK the country could lose billions.

HMRC figures suggest that, quite apart from the hundreds of millions they pay in annual charges, non-doms also contribute more in income tax, national insurance and capital gains tax than the average taxpayer.

In 2011/12 non-doms collectively paid £8.5bn in these three taxes, the taxman tells us. Mark Davies says the average non-dom who claims the tax advantage still pays about £130,000 a year in income tax alone – about 25 times the average individual.

Would the non-doms simply up sticks? Tax campaigners tend to say fears of this kind of flight are overcooked, whereas industry insiders, equally unsurprisingly, say the danger is real.

Jon Elphick from Mark Davies and Associates told us: “These are the guys who can leave the UK. These are the guys who have homes in multiple countries. It’s very easy for them to move and not pay any UK tax.”

How do the parties differ?

Labour claim that they will “abolish non-dom status”, but shadow chancellor Ed Balls has said foreigners who come to Britain for two or three years will still not have to pay tax on foreign income.

In fairness, that is a tougher line than some tax campaigners like Richard Murphy have suggested.

The Lib Dems have pledged to reform eligibility rules and increase charges if elected.

George Osborne has already increased charges for non-doms but the Treasury is unapologetic about letting the tax advantage stay.

Policy documents state: “We recognise the significant contribution that non-UK domiciled individuals make in the UK, creating jobs and inward investment. That is why we stand firmly behind the remittance basis of taxation, which is a unique way of taxing people.

“With the changes announced at Autumn Statement 2014, the UK will continue to offer a very competitive tax regime, allowing people who are not domiciled here to base themselves in the UK for a long time whilst maintaining a different tax status.”