UK debt crisis: poorest face ‘perfect storm’

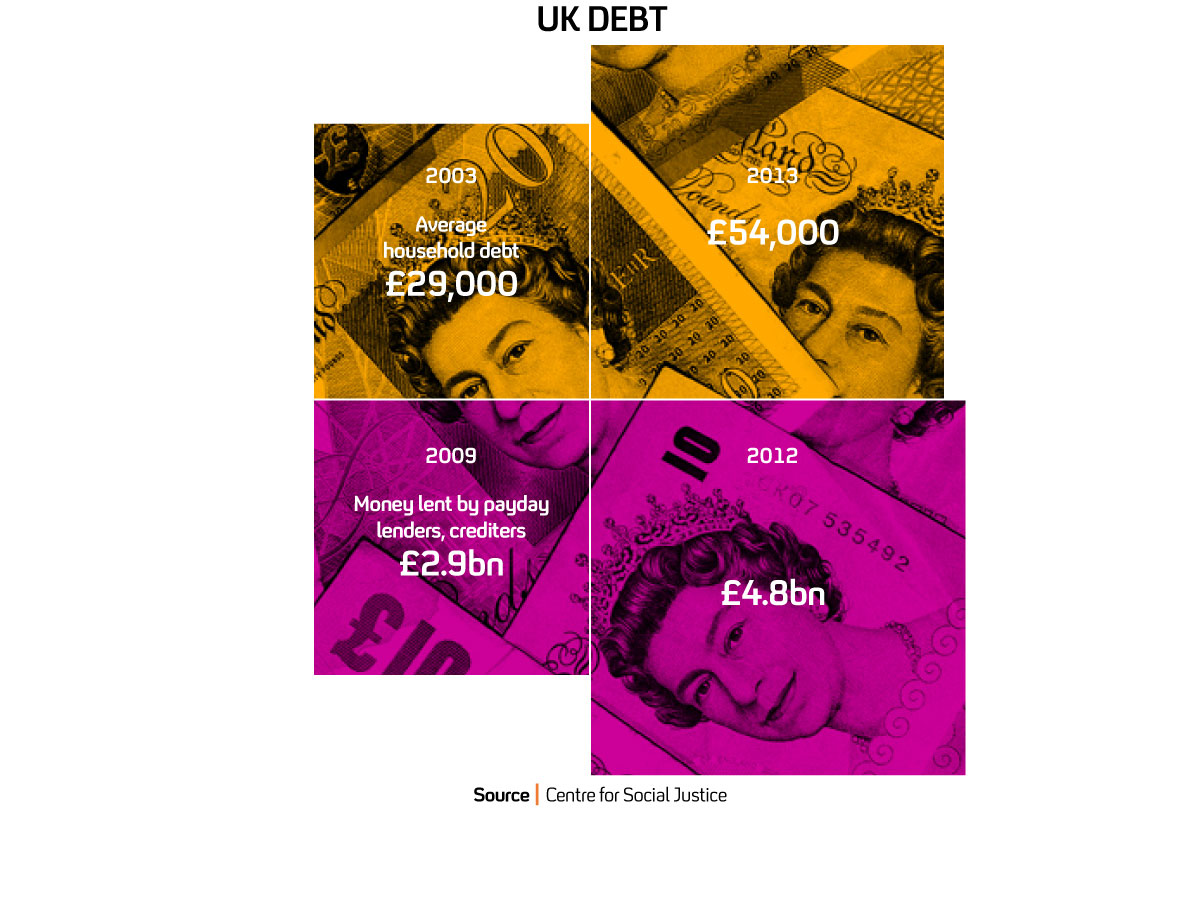

Average household debt has doubled in a decade despite low interest rates, says the Centre for Social Justice, with total UK debt rising to a peak of £1.4tn.

Around 3.9m British families do not have enough savings to cover their rent or mortgage for more than a month, and poorer people are “bearing the brunt of the storm”, said the right-leaning think tank.

The report from the Centre for Social Justice (CSJ) which was founded in 2004 by Iain Duncan Smith – now work and pensions secretary – warns of rising homelessness as a result of households being unable to make monthly payments. More than 26,000 UK households were accepted by councils as homeless in the last five years because of rent and mortgage arrears, including more than 5,000 last year, the think-tank said.

Despite signs of a national economic recovery, the CSJ found that personal debt in the UK remains close to its all-time high of £1.4tn, while average household debt now stands at £54,000 – nearly twice the level of a decade ago. It added that personal debt problems pre-date economic crash and have been building for decades.

Some of the poorest people in Britain are cut off from mainstream banking and have no choice now but to turn to loan sharks and high-cost lenders – CSJ Director Christian Guy

The report, Maxed Out, written by former Labour work and pensions minister Chris Pond, raised concerns over the rising cost of domestic energy and other household bills.

It concluded that poorer people were facing the worst of the “perfect storm” of rising living costs, falling real wages, low savings and expensive credit that has seen unsecured consumer debt almost triple in the last 20 years, reaching nearly £160bn.

Households in the poorest 10 per cent of the country have average debts more than four times their annual income, the study found, with their average debt repayments amounting to nearly half their gross monthly income.

Debt ‘can wreak havoc on mental health’

The report also notes the rise in payday loan customers to 310,000 people, with around half of those who take out a payday loan reporting that it was the only form of credit they could get.

CSJ director Christian Guy said: “Years of increased borrowing, rising living costs and struggling to save has forced many families into a debt trap that is proving very difficult to escape.

“Problem debt can have a corrosive impact on people and families. Our report shows how it can wreak havoc on mental health, relationships and wellbeing.

“Across the UK people are up until the early hours worrying about their finances and bills.”

“Some of the poorest people in Britain are cut off from mainstream banking and have no choice now but to turn to loan sharks and high-cost lenders.”

The CSJ report also points out that 1.4m people have no transactional bank account, and it estimates that millions of other people do not use their bank account because of fears over penalties and overdraft charges, which can often be more expensive than payday loans.

-

Latest news

-

Laughing Boy: New play tells the tragic tale of Connor Sparrowhawk5m

-

Sewage warning system allows some of worst test results to be left off rating system, analysis shows3m

-

Post Office inquiry: Former CEO didn’t like word “bugs” to refer to faulty IT system4m

-

Israeli soldier speaks out on war in Gaza12m

-

PM’s defence spending boost should be ‘celebrated’, says former Armed Forces Minister4m

-