Unions clash with coalition over pension review

A clash is looming between the government and unions over plans to reform public sector pensions. Report author Lord Hutton tells Channel 4 News: “There is change coming”.

The former Labour Pensions Secretary Lord Hutton has published his interim pension review, calling for long-term structural reform of public sector pension schemes, including ending final salary pensions.

He also called for a new model of pensions to be introduced which share the risk more fairly between Government and workers.

However, he did rule out replacing the final salary schemes with individual funded defined contribution schemes, which would see the workers bearing all the risk. This is something that has already happened extensively in the private sector.

Lord Hutton was commissioned to carry out the review by Chancellor George Osborne, who warned the “unsustainable” rise in the annual bill for public sector schemes needed to be tackled.

“I don’t believe the current model is sustainable.” Lord Hutton

Lord Hutton says he will consider a range of alternatives before publishing his final report. Some of the alternatives he may consider include a career average scheme, whereby the pension is based on the average salary of a worker through their career, rather than the salary they are earning just before they retire.

Hybrid schemes, which share the risk, are another option. Collective or notional defined contribution schemes may also be considered.

Lord Hutton has advised the Government to raise individual contributions to schemes, if it wants to make short-term savings. But he stressed the Government should ensure that low-paid workers should be protected from the increases as should the Armed Forces.

Who Knows Who: Lord Hutton

Not “gold-plated”

He dismissed descriptions of public sector pensions as being “gold-plated”, claiming the average pension paid out is around £7,800 a year, with half of people receiving less than £5,600 and 10 per cent getting £1,000 or less.

He told Channel 4 News that a “fundamental reappraisal” was needed of public sector pension schemes.

“I don’t believe the current model is sustainable,” he said. “I don’t think it strikes the right balance on fairness or sustainability of affordability.

“We need to re-examine how we provide these pensions, but what I don’t want to do is follow a downward path – a race to the bottom where we actually force more and more public servants, when they leave public service, into poverty in retirement, because that is a false economy – because we are only going to have to make up the difference in welfare benefits.”

Lord Hutton said there was “change coming”, but he wanted to pursue a “sensible” approach.

“I am saying there is a case to look again at what the pension contributions from public service employees should be to meet the promise we are making to them on their pensions.”

He added that the retirement age would also have to be re-examined. “Allowing people to continue to retire at 60 flies in the face of what is happening on longevity and is not fair between the generations,” he added.

Trade unions revolt

Yesterday trade unions warned that slashing pensions will add to the “volatile cocktail” of job and pay cuts which are already blighting health, education, local government and other employees.

Teachers, NHS staff, council workers and civil servants may have to increase payments into pension schemes as early as April.

But trade unions are angry at the plans because their members are facing the real possibility of job cuts.

The TUC General Secretary, Brendan Barber, said: “Public servants are already facing job cuts, a pay freeze and intensified workloads as staff are not replaced. Cuts in their pension provision and increased contributions that lead to a cut in take home pay, at a time when inflation is biting, will add to the volatile cocktail of issues they face.”

Meanwhile Unite warned that women will be hit by inequality in the workplace if the quality of public sector pensions is reduced.

“The orchestrated campaign of myth and misinformation about public sector pensions has been frustrating and demoralising.” Chris Keates NASUWT

Unite Assistant General Secretary Gail Cartmail said: “The evidence shows that decent occupational pensions reduce inequality in society. A race to the bottom will be a betrayal of fairness and lead to the deterioration of pension provision for working people across the board.

“Eroding the quality of public sector pensions will hit women the hardest. Many women may have no choice but to vote with their feet and opt out of pension schemes altogether or even leave the public sector.

Public sector pensions: Your questions answered

“The hysteria over public sector pensions has been whipped up by the Coalition Government, private sector employers and pension industry experts. They have not hesitated to manipulate the facts to make a case for attacking public servants.”

The General Secretary of the Public and Commercial Services Union, Mark Serwotka, said: “A fair scheme was agreed with the government in 2007 and we do not accept a need for that to be the subject of further review.

“We reject the Government talk of gold-plated pensions and the deception they are either unfair or unaffordable. Excluding the very highest earners, the average civil service pension is £4,200 a year. More than 100,000 people receive a civil service pension of £2,000 or less a year. More than 40,000 receive less than £1,000, and more than 60,000 get between £1,000 and £2,000.”

Public sector vs private sector

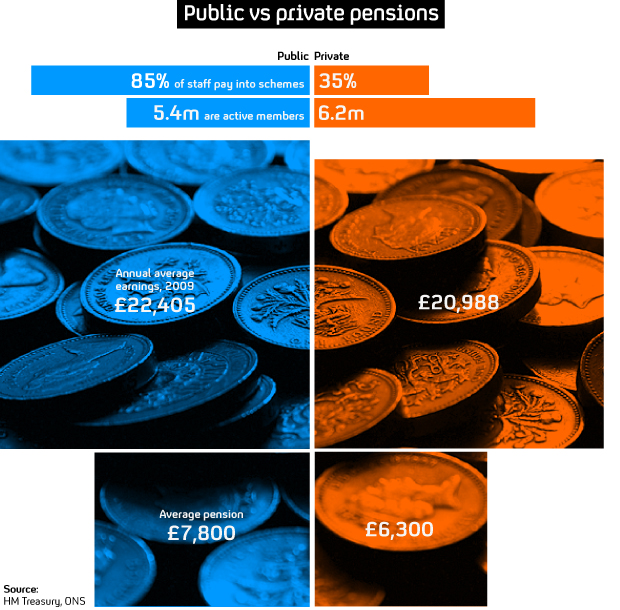

Lord Hutton’s report only looks at public sector pensions, partly because the systems and numbers behind public and private sector pensions are so different, as the graphic (above) exposes.

Perhaps the biggest difference between the two is the number of people paying into them – 85 per cent of public sector staff pay into a pension scheme, while just 35 per cent of private sector employees do.

“Unfair and unjust”

Head of teachers’ union NASUWT, Chris Keates said: “It will be totally unfair and unjust if the outcome of the interim report is that there are to be further punitive changes to teachers’ and other public service workers’ pensions.

“The orchestrated campaign of myth and misinformation about public sector pensions has been frustrating and demoralising, just as the coalition Government, and the other obsessive opponents of public services, intended.

“The average public sector worker’s pension is £5,000. The average pension for teachers is just under £10,000. Hardly gold-plated.”

And the General Secretary of the Rail Maritime and Transport union, Bob Crow, who has already led walkouts on the London Underground due to job cuts, has attacked Lord Hutton for even carrying out the review.

He said: “It is a scandal that a former Labour minister is acting as nothing more than an enforcer for the Con-Dems in their attack on public sector pensions.

“While the top bosses are piling up tax breaks that allow them to retire to their villas and yachts at 55, it’s going to be work till you drop for nurses, teachers and transport workers, with a pittance at the end of it, if this Government get their way.

“In France millions of people have taken to the streets and picket lines in defence of their pensions and we need the same kind of response here if we are to stop the Government robbing us of our retirement.”

The Chief Executive of the National Association of Pension Funds Joanne Segars, said: “Private sector pensions have had to change a lot over the past few years, and the public sector also needs to make reforms to become more sustainable.

“However, this must not become a race to the bottom. Public sector workers, like all workers, deserve a good retirement.”

State pensions – the numbers

The coalition says there is an "urgent need" to cut the spiralling cost of the state pension.

• £54.9bn spent by the Government on the basic state pension in 2009/10, up from £48.8bn in today's prices only four years earlier.

• £3.5bn the Government could save for every year the pension age is raised.

• 12.2 million people above state pension age in the UK. By 2050 this will have soared to 20.9 million if the age at which people can claim their pension is not raised.

• £97.65 a single person can get on a basic state pension in 2010-11

• 70 - Retirement age recently suggested by Lord Turner, head of the Pensions Commission.

• 68 - Age at which the previous government planned to raise the age to for state pension by 2046.

• 34 per cent of men expected to reach 65 when the first contributory state pension was introduced in 1926. 40 per cent of women were expected to reach the age.

• 12 years men would live for after reaching 65 in 1950, according to the Office for National Statistics.

• 21 years men are now expected to live beyond 65. Women are likely to live for another 24 years, according to the Department for Work and Pensions. By 2050, it is likely a man who is already aged 65 will live for another 25 years and a woman will live for a further 28 years.

• Four people of working age for every one person over the state pension age. By 2050 it is predicted there will be just two people of working age for every person who is retired.

The pensions analyst, Dr Ros Altmann, told Channel 4 News that public sector workers were subsidised by those in the private sector.

“I think the interim report is a bit of a reality check for public sector pensions, recognition that final salary pension schemes are unfair and also that the contributions being made by public sector workers don’t in any way realistically reflect the value of the pension they are going to get – as well as pointing out that the risk of the cost of paying these pensions falls entirely on taxpayers and not on the workers themselves,” she said.

“It doesn’t sound a lot to have a £7,800 pension but the reality is that this is worth over a quarter of a million pounds so the average public sector worker when he or she retires is getting from the taxpayer the equivalent of over a quarter of a million pounds for their retirement. Most private sector workers wouldn’t be able to dream of saving that money during their working life.”

-

Latest news

-

Taylor Swift’s new break-up album breaks records3m

-

NHS trust fined £200K for failings that led to death of two mental health patients3m

-

Sunak vows to end UK ‘sick note culture’ with benefit reform3m

-

‘Loose talk about using nuclear weapons is irresponsible and unacceptable’, says head of UN’s nuclear watchdog3m

-

‘There wasn’t an Israeli attack on Iran,’ says former adviser to Iran’s nuclear negotiations team7m

-