The Co-op, Paul Flowers and Labour: what we know

With an inquiry to be held into Paul Flowers’ appointment as Co-op Bank chairman, the Conservatives are also drawing attention to his links to the Labour party.

David Cameron told the Commons there were “a lot of questions that have to be answered” about Paul Flowers, who chaired the bank from 2010 until July.

He was speaking following a police search of the Methodist minister’s home in Bradford after the Mail on Sunday showed video of him allegedly buying cocaine. The Methodist Church has suspended him indefinitely.

Labour leader Ed Miliband has been drawn into the affair because of the financial backing his party has received from the Co-op Group.

Mr Flowers resigned as a Labour councillor in Bradford after adult material was found on his computer in September 2011.

At the time, he said he was doing so for personal reasons and because of his increased responsibilities at the Co-op. He has been suspended from the Labour party for bringing it into disrepute.

Gross indecency

It also emerged that he was convicted of gross indecency in 1981, reportedly over a sex act in a public toilet.

Speaking then, a Methodist Church spokesman said he had gone through the “usual procedures” before being allowed to continue in his role. “He was very contrite and he continued his work,” he said.

The Conservatives want Mr Miliband to explain when they were made aware that Mr Flowers had resigned as a Labour councillor.

They are also calling for details of private meetings with Mr Flowers when he was Co-op Bank chairman, an explanation as to why he was a member of Labour’s business advisory group, and the return of the £50,000 donation the Co-op made to the office of shadow chancellor Ed Balls.

Private meeting

A Labour source told the Press Association: “It’s true that there was a private meeting with Ed (Miliband) in March of this year. There were two informal dinners, three meetings that we can find records of in the space of three years. This shows that Mr Flowers was neither influential nor important.”

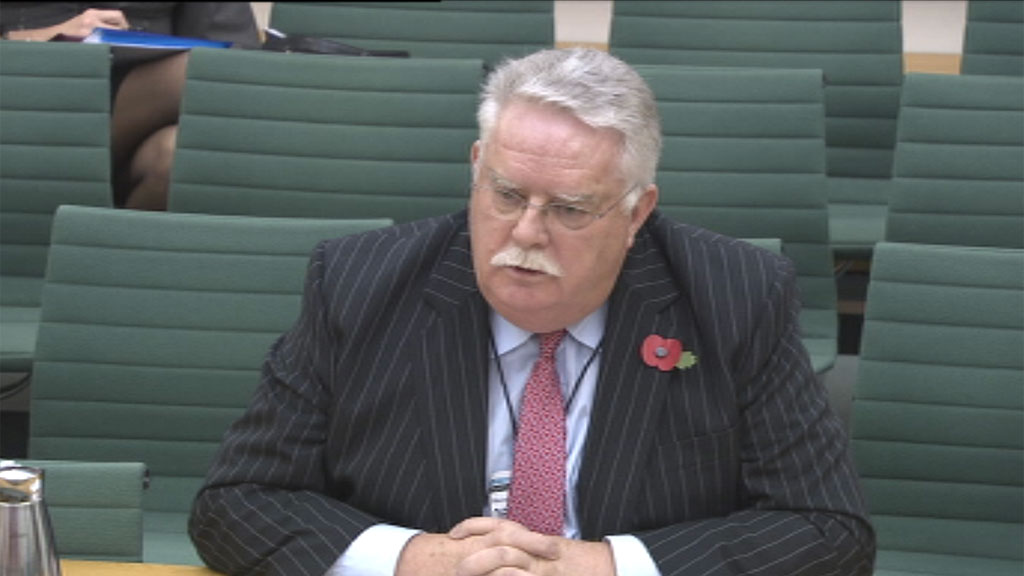

When he appeared in front of the Treasury select committee in November, Mr Flowers was asked whether he had approved the £50,000 donation as a member of the Co-op Group’s board.

He replied: “My recollection is that we paid for a particular researcher to assist the shadow chancellor in the work that he needed to do, and that we believed to be a legitimate and proper use of resources.”

Figures from the Electoral Commission show that Labour headquarters has received donations of £278,500 from the Co-op Group since 2002.

The party has taken out loans of £16,725,000 from the Co-op Bank since 2006, all of which have ended. Two other loans, of £1,297,500, are outstanding.

One of these loans, for £1,217,500, began on 1 April, the month after Ed Miliband met Paul Flowers. Labour has refused to say whether they discussed the loan at their meeting.

A spokesman for Mr Balls said: “The Co-op Group, not the bank, donated £50,000 to the shadow chancellor’s office which was declared in the normal way at the time.

“Ed has never discussed the donation with Paul Flowers. Ed’s been to a few events which Rev Flowers has also been at, but he’s never had a meeting or phone conversation with him.”

‘Broken a bank’

Mr Cameron told MPs the Labour party had failed to alert the authorities to Mr Flowers’ past:

“Why did they do nothing to bring to the attention of the authorities this man who’s broken a bank?” He asked.

“This bank, driven into the wall by this chairman, has been giving soft loans to the Labour party … donations to the Labour party, trooped in and out of Downing Street under Labour, ill-advising the leader of the Labour party, and yet now we know all along they knew about his past.”

Labour says the party leadership did not know why Mr Flowers resigned as a Bradford councillor and thus felt no need to tell the authorities when he was appointed Co-op Bank chairman.

The Co-op Bank, long considered an ethical alternative to its bigger high street rivals, is nursing a £1.5bn hole in its balance sheet and is hoping to be rescued by US hedge funds.

Its financial problems date back to its decision in 2009, when Mr Flowers was a board member, to buy Britannia building society, which left it saddled with debt.

As a non-banker, Mr Flowers’ qualifications to chair the Co-op Bank have been questioned.