Osborne: Portugal bailout shows cuts are needed

As Portugal becomes the latest EU country to ask for a bailout, George Osborne says the Government’s austerity measures are needed to prevent a similar crisis in the UK. Faisal Islam takes a look.

Britain could have to pay up to £4bn towards the emergency European Union bailout.

Chancellor George Osborne used the crisis to justify the Government’s austerity cuts, saying he refused to play “Russian roulette” with the economy.

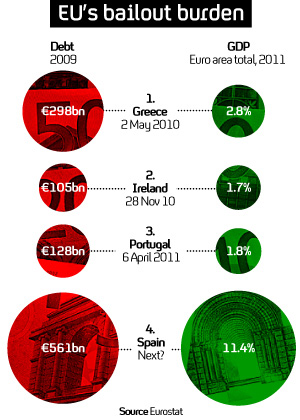

“Look at what is happening around us. First Greece, then Ireland and today Portugal,” he told the British Chambers of Commerce annual meeting.

“Today of all days we can see the risks that would face Britain, if we were not dealing with our debts and paying off our national credit card.

“These risks are not imaginary – they are very, very real.”

“We can see the risks that would face Britain, if we were not dealing with our debts. These risks are not imaginary – they are very, very real.” Chancellor George Osborne

Prime Minister Jose Socrates said in a televised statement that Parliament’s rejection of austerity measures last month had aggravated the financial situation, making the request for aid “inevitable”.

Spain next?

Spain moved quickly to stem market jitters, saying it would not be following these countries in seeking assistance.

“(The risk of contagion) is absolutely ruled out … it has been some time since the markets have known that our economy is much more competitive,” Spain’s Economic Minister Elena Salgado said.

Political economist Stephen Barber told Channel 4 News that all eyes are now on Spain, amid concerns it could be the next domino to fall.

“With Spain, we’re in a very different league to Portugal or Ireland. We’re talking a trillion-euro economy.

Read more in the Channel 4 News Special Report: from crash to cuts

“Unlike Portugal, it still has the capacity to grow so it’s in a far better position. But if it does go, it’s a lot more worrying because it’s almost too big to bail out,” he said.

“The political ramifications of a potential Spain bailout are quite substantial. If that were to happen, then the market would start to look at countries like Italy and question the whole European model.” Angus Campbell, Head of Sales, London Capital Group

London Capital Group’s Angus Campbell told Channel 4 News that while the market has steadied, the broader effects of a possible Spain bailout would be devastating.

“The political ramifications of a potential Spain bailout are quite substantial. If that were to happen, then the market would start to look at countries like Italy and question the whole European model.”

Who foots the bill?

European Union officials estimate Portugal will need as much as €80 billion in emergency funds.

It comes just weeks after an EU summit committed to a permanent 700 billion euro bail-out facility for eurozone countries in trouble.

The UK is not part of that fund, but it is included in the temporary 440 billion euro bail-out fund which was set up to help Greece and which runs until mid-2013.

“There are growing divisions in the EU with those in the eurozone and those out of it. But ultimately, our banks are heavily exposed. And it’s in Germany and Britain’s interests to make sure our economises are stabilised.” Stephen Barber, political economist

Public sentiment

But economists told Channel 4 News that even if the public don’t like it, it’s in “Britain’s best interests” to contribute to the bailout.

“There are growing divisions in the EU with those in the eurozone and those out of it,” Stephen Barber told us.

“But ultimately, our banks are heavily exposed. And it’s in Germany and Britain’s interests to make sure our economises are stabilised.

“While Britain might not be a member of the eurozeone club, it is still expected -and it’s in its best interests- to put a hand in its pocket. Even if the public don’t appreciate their taxes going into these bailouts,” he said.

Carving EU divisions

Angus Campbell told Channel 4 News that while the EU can “certainly afford” the bailouts, the political divisions will pose a bigger problem.

“If hypothetically in a few years time we’ve seen Spain and another country go, then there would be major doubts over Germany’s continued political willpower,” he said.

Professor Barber says the tightening of monetary policy is impacting weaker economies.

“Germany is driving the Eurozone, and the public don’t like the fact that with 4 per cent growth and high employment, they have to bail out the weaker economies. Merkel’s popularity has taken a battering.

“But if you’re the Finance minister of Portugal, you’re no longer in control of fiscal policy. So you’re no longer running these things. And with elections coming up in June, that poses big problems.”

The issues facing the eurozone are expected to dominate talks between EU leaders in Budapest on Friday.