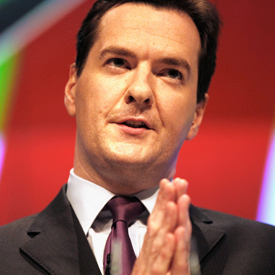

Osborne attacks ‘anti-business’ culture

Chancellor George Osborne warns that the row over bonuses and pay threatens to undermine business and the free market economy, as Stephen Hester urges RBS staff to “prove critics wrong”.

He defended the principle of “rewards for success” during a speech on Tuesday night, saying that a strong economy is built around this principle.

His comments came as RBS Chief Executive Stephen Hester broke his silence after waiving a bonus of almost £1m in shares last week.

In a letter to staff at the largely state-owned bank’s, Mr Hester said press coverage had been “discomforting to say the least”, but said that RBS was “making progress in the face of a difficult inheritance”. He told staff they needed to “prove the critics wrong”.

Speaking at the Federation of Small Businesses, the chancellor said that reform of the banking system is necessary and that rewards for failure are “unacceptable”.

“But a strong, free market economy must be built on rewards for success,” he added.

“There are those who are trying to create an anti-business culture in Britain – and we have to stop them. At stake are not pay packages for a few but jobs and prosperity for the many.”

There are those who are trying to create an anti-business culture in Britain – and we have to stop them. At stake are not pay packages for a few but jobs and prosperity for the many. Chancellor George Osborne.

The chancellor’s speech followed a House of Commons debate in which Labour demanded a repeat of the tax on bankers’ bonuses and pressurised the prime minister over “excessive” pay in the City.

Labour had planned to force a vote on Mr Hester’s bonus during opposition day in the Commons, but turned the spotlight on the wider issue of pay, reform and responsibility in the banking sector after the RBS chief executive turned down his reward package.

Shadow business secretary Chuka Umunna dismissed the accusation that Labour is “anti-business” for focusing on the massive financial rewards handed out to some of those at the top of the financial sector, adding: “The most vociferous critics of our banks are the small and medium-sized businesses who make up the overwhelming majority of businesses in this country.”

He said large bonuses in banks bailed out by the taxpayer should reflect “genuinely exceptional performance” rather than being the norm.

But Treasury minister Mark Hoban told MPs that Labour was to blame for the “cash bonus culture” which took hold in the City during its 13 years in power.

The coalition government is reforming regulation, taking action to stimulate lending and changing the rules on pay to keep bonuses down, he added.

“We are remedying what the chancellor has described as ‘the biggest failure of economic management and banking regulation in our country’s history’ and that failure was presided over by the party opposite,” said Mr Hoban.

-

Latest news

-

As India goes to the polls in the world’s largest election – what do British-Indians think?6m

-

Tees Valley: Meet the candidates in one of the biggest contests coming up in May’s local elections4m

-

Keir Starmer says public sector reform will be a struggle7m

-

Nicola Sturgeon’s husband Peter Murrell charged with embezzlement of funds from SNP1m

-

Ukraine might finally get $60billion in American weapons and assistance to defend against Russia3m

-