Budget 2011: the analysis

Chancellor George Osborne delivers a “keep calm and carry on” Budget – with some surprises, including fuel price cuts for the consumer. An expert picks out the key points for Channel 4 News.

Chancellor George Osborne‘s first full Budget has delivered crowd-pleasing cuts to petrol prices, as well as boosts for business and entrepreneurs.

But it all has to be paid for somewhere – and the banks and oil companies are less likely to be happy with the numbers outlined today as they face higher levies to pay for the consumer giveaways.

Amidst the detail of the Budget, there was also some grim economic news – the Office for Budget Responsibility has cut is growth figures for 2011 by 0.4 per cent.

Budget 2011: Osborne claims 'fuel in the tank' for Britain

But what do the numbers mean for you? Channel 4 News spoke to expert Caroline Artis, a tax partner at Ernst and Young.

She said: “It was definitely a Budget for growth – a ‘keep calm and carry on’ war time motto.

He had to tread a thin line between giving people something to keep their spirits up, but making sure there is enough money in the kitty to keep on paying the bills. Ernst and Young’s Caroline Artis

“The key points for the consumer are what wasn’t here – there was no reduction in VAT and so that means that we’ve got 20 per cent VAT on goods and services for at least another year.

“Now what was there – there was the surprise reduction in fuel duty as well as the abolition of the rises in fuel duty that nobody was looking forward to. The extra personal allowances on income tax – which are, unusually, going to be available for 40 per cent tax payers as well – mean that 22m people will be better off.”

She said non-domiciles will be breathing a “sigh of relief” at the measures affecting them in the Budget.

Economy

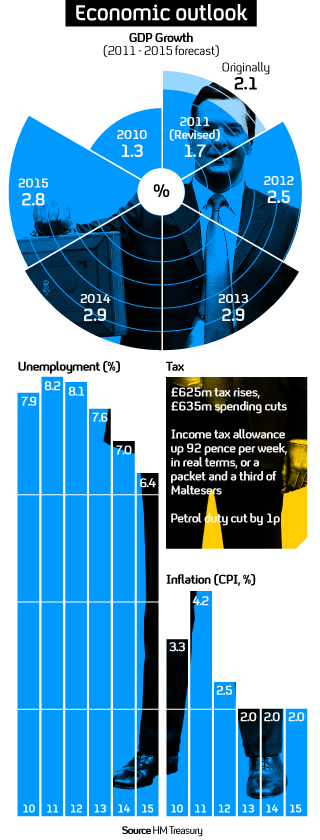

As the graphic (left) shows, the Chancellor delivered his Budget amid a bleak economic picture – but he hopes the measures will lead to growth in the next couple of years.

While GDP growth for this year was revised downwards from 2.1 per cent to 1.7 per cent, it will pick up from 2012 – while inflation and unemployment should both fall, according to the Office for Budgetary Responsibility predictions.

Business

A key part of ensuring this economic recovery, though, lies with business. Ms Artis said the Budget had a major focus on improving business confidence.

“A really big part of the message is with the reduction of public sector jobs, the Government is looking for the private sector to take that up and ensure that unemployment remains at manageable levels.

“But further still, with this Budget, they are saying – don’t wait for someone to give you a job, go out and create your own. There’s strong encouragement for entrepreneurs to set up and build their businesses, and doubling entrepreneur’s relief means that if you do make a success of it your capital gains tax bill would be halved.”

Cutting corporation tax is also a major step to convince business that the Coalition is on their side, she said.

More from Channel 4 News: Where can you get the UK's cheapest petrol?

“For business it was the surprise extra 1 per cent reduction in the corporation tax rate, which is a very strong indication that the Government wants other multinational companies to see Britain as a great place to set up and run their businesses. We were around average in corporation taxes and this takes us back into the very competitive end of corporation tax in the G20.

“And business genuinely would look to the simplification of taxes as a real way of them saving overhead costs and be able to invest more money and create more jobs.”

But giveaways for the consumer are being paid for by levies on the banks and oil companies.

“For a bank or oil company, it’s not such good news. There are extra taxes for the banks and the fuel surcharge for oil companies providing the funds for the Government to make concessions to individuals.”

Economy

Overall, the Budget is one for a “fragile economy”.

“The Budget had elements of surprise,” said Ms Artis.

“But George Osborne was also keen to flag that he would have done more in the economy had permitted it, things like saying he regards the 50p tax rate as a temporary state of affairs and he sees the trend of corporation tax going down, suggesting as soon as the economy permits it he will continue to reduce the tax burden.

“It’s clear that the economy is not in recovery – it’s very fragile. He had to tread a thin line between giving people something to keep their spirits up, but making sure there is enough money in the kitty to keep on paying the bills.

“It’s a real kind of post-war, austerity type Budget. It sounds a bit like 1947 – a royal wedding and an austerity Budget.”

As it happened: the Budget 2011 Live Blog

Watch below: analysis from Manchester Business School’s Professor Chris Bones.

Budget 2011 – the reaction

Ed Balls, Shadow Chancellor: “The idea that drivers around the country should be grateful for a 1p cut in fuel duty when George Osborne’s VAT rise is adding 3p to the price of petrol is laughable.”

John Cridland, CBI Director General: “Businesses and consumers will benefit from reduced fuel taxes, but the increased tax on North Sea oil and gas could be counterproductive, and will create uncertainty for future investment.”

Andrew Smith, Chief Economist at KPMG in the UK: “Last year was the preview, this year austerity is for real with tax rises and spending cuts each of 1 per cent of GDP. Today’s concessions are small beer by comparison with this squeeze.”

Geoff Dunning, Chief Executive Road Haulage Association: “Today’s [fuel duty] cut will go some way to bringing relief to an industry that has quite literally been fighting for its survival. However, the inflation element has not been cancelled but simply postponed and we face two sharp increases in quick succession next year.”

Matthew Sinclair, TaxPayer’s Alliance Director: “Unfortunately the rehetoric about simplifying taxes wasn’t matched in the reality of the Chancellor’s policies and there were too many fiddly little changes that will create new loopholes and make tax harder to understand.”

Brendan Barber, TUC General Secretary: “Today has been a no-change budget… While there are some welcome measures on funding for apprenticeships and much needed relief on fuel duty, most of today is about taking us back to the 1980s with deregulation gimmicks, hand-outs to big businesses and a deterioration of working conditions that failed to deliver jobs or growth then and won’t today.”

Len McCluskey, Unite General Secretary: “George Osborne just rearranged the furniture, when Britain needed a plan B.”

Anne Marrie Carrie, Barnardo’s Chief Executive: “40,000 apprenticeships are a drop in the ocean… Whilst the extra apprenticeships are real opportunities for those who can access them, they are still beyond the grasp of the many vulnerable young people we work with, including young carers, disabled children and homeless young people.”

Campbell Robb, Shelter Chief Executive: “This first time buyers’ package is the policy equivalent of sticking plaster on a broken leg, and will have little impact on our housing crisis. Today’s announcement will help less than one per cent of people struggling to get on the housing ladder, leaving them more likely to win the lottery than be helped through this small-scale scheme.”

-

Latest news

-

As India goes to the polls in the world’s largest election – what do British-Indians think?6m

-

Tees Valley: Meet the candidates in one of the biggest contests coming up in May’s local elections4m

-

Keir Starmer says public sector reform will be a struggle7m

-

Nicola Sturgeon’s husband Peter Murrell charged with embezzlement of funds from SNP1m

-

Ukraine might finally get $60billion in American weapons and assistance to defend against Russia3m

-